Fireblocks Integrates With Largest DeFi Lending Network

Launches Secure Access to Compound for Institutions

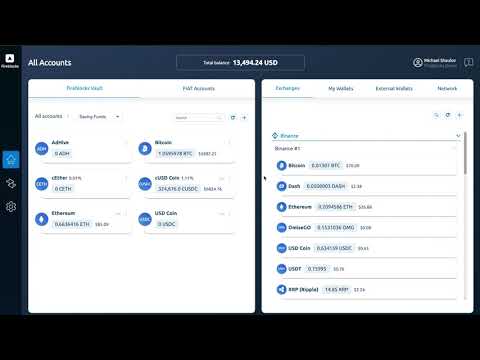

Fireblocks, the most trusted digital asset security platform for institutions, announced it has integrated with Compound (compound.finance), a Decentralized Finance (DeFi) lending platform with $163M in interest-earning assets across 8 markets. This is the first and only institutional implementation of MPC on a DeFi protocol, providing secure and instantaneous access to the billion-dollar DeFi economy.

Starting today, OTCs, Market Makers, Hedge Funds, and Exchanges can safely deploy assets onto Compound – an algorithmic, autonomous interest rate protocol offering 3-7% interest with the click of a button.

The Compound integration offers a number of different use cases for Fireblocks’ customers. Customers like AmberAI are looking to passively earn interest on digital assets stored in their Fireblocks Hot Vault, even in short intervals. At the same time, Parafi, an alternative investment firm specializing in decentralized finance, is employing Fireblocks to safeguard assets from the growing number of crypto cyberattacks.

Recommended AI News: Proactive Vs Reactive: Eliminating Passive Safety Systems With New Technology Trends

“The integration between Compound and Fireblocks allows us to deploy systematic DeFi credit strategies while maintaining the highest level of fund security on an institutional-grade platform,” says Kevin Yedid-Botton, CEO of Parafi.

Before Fireblocks, the primary method for accessing Compound’s services was through MetaMask – a Chrome web extension-based token wallet and key vault. While this was sufficient for some retail customers, institutions have largely been unable to interact with smart-contract based platforms, leaving them on the sidelines of a $4.7 billion digital asset lending industry.

Recommended AI News: Spherix Incorporated Changing Name to AIkido Pharma Inc. to Reflect Increased Focus on AI and ML in Drug Development

“This integration offers unparalleled security around private key protection for smart-contracts,” said Uri Stav, CSDO at Genesis Global Trading. “As Compound is a smart-contract based protocol, leveraging MPC is the only way to layer institutional controls like multi-user approvals and eliminate a single point of compromise when depositing funds into Compound, and during redemption of the loan.”

Fireblocks plans to continue expanding upon its integration with Compound and other smart-contract based platforms to provide a secure pathway for institutions to participate in DeFi innovation.

“The industry has been waiting patiently for a secure, institutional platform that can access Compound markets,” said Robert Leshner, CEO, and Founder of Compound. “Being able to add incremental returns into your existing workflow is a game-changer that will allow institutional investors to enter decentralized finance for the first time.”

Recommended AI News: Concentra Launches TrueCue, Its Combined Analytics Products & Services Brand