Bitcoin IRA: Cryptocurrencies Lead Dramatic Price Gains Over Traditional Assets

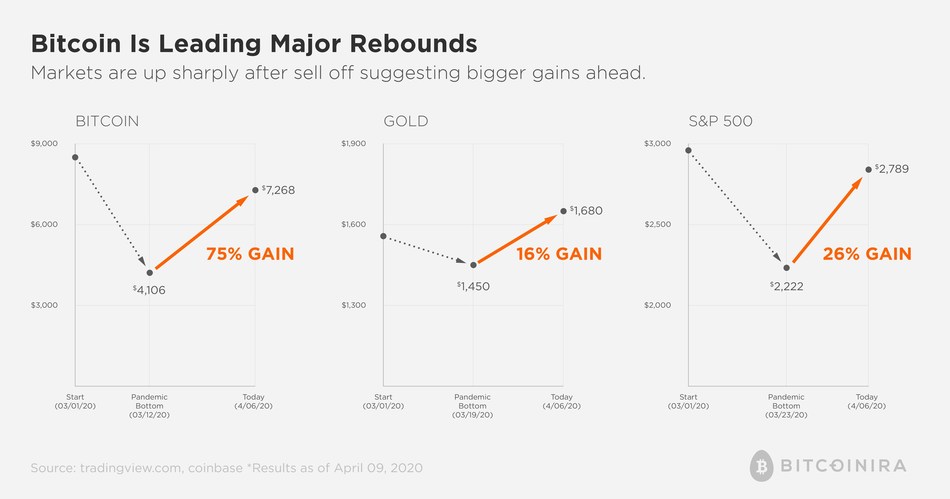

Since March 1st, 2020 Bitcoin has recovered significantly higher than the S&P 500 and DOW after hitting a likely bottom

Bitcoin IRA, the world’s first, largest and most secure digital asset IRA technology platform that allows clients to purchase cryptocurrencies and other digital assets for their retirement accounts, highlights that cryptocurrency is recovering higher from the coronavirus market sell-offs than nearly all other traditional investments including the DOW and the S&P 500, as of April 9th, 2020.

Bitcoin is now trading 75% higher, around $7,300, up from its lows of near $4,000 on March 12th, also known as “Black Thursday” for many cryptocurrency investors. While the S&P 500 also rebounded sharply from its bottom, gold remains one of the best performing assets in 2020 with a 10% gain, compared to Bitcoin and the S&P 500, and its price per ounce reached an 8-year high. Gold is often considered a safe-haven asset in times of economic uncertainty and the COVID-19 pandemic is driving record demand for the precious metal.

Recommended AI News: Identity Theft is Booming; Your SSN Sells for Less than $4 on Darknet

Bitcoin IRA recently announced it began offering physical gold for clients to easily buy and sell inside their retirement accounts as part of their technology platform in addition to 7 leading cryptocurrencies including Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Litecoin (LTC), Bitcoin Cash (BCH), Stellar Lumens (XLM) and Zcash (ZEC).

Recommended AI News: Opinion: Young Jamaican’s Invention Could Help Tackle Spread of Viruses Like COVID-19

In roughly 30 days Bitcoin will go through a major event that occurs every four years, called the “Halving.” This event cuts its inflation rate in half, to just 1.8%, and increases its scarcity to closely match gold and silver. This math-based mechanic is expected to drive up attention for Bitcoin as a strong store of value while at the same time concerns are increasing with the US dollar over upcoming inflation and endless debt creation. These factors could lead Bitcoin to greatly out-perform traditional assets in the future.

Recommended AI News: Automation Provides A Content Lifeline For Remote Work

Comments are closed, but trackbacks and pingbacks are open.