Xignite Introduces New Corporate Actions Cloud API

The New API Helps Firms Prepare for the Post-Pandemic “Perfect Storm” Brewing in the Retail Markets.

Xignite, Inc., a provider of cloud-based market data distribution and management solutions for financial services and technology companies, introduced XigniteGlobalCorporateActions, a new advanced API providing detailed corporate actions data for events such as stock splits, dividends, mergers, and spinoffs. The COVID-19 pandemic has led to a dramatic increase in corporate actions, annual meetings canceled, dividend payouts suspensions, and an accelerated company mergers and acquisitions rate. Knowing when a company plans to offer a split or undertake an acquisition is critical for buy-side and sell-side firms.

Recommended AI News: Kyndryl Names Michael Bradshaw as Chief Information Officer

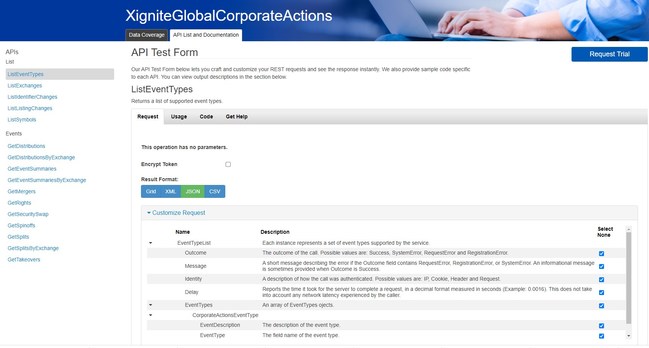

Corporate action processing is one of the “last frontiers of pain” for investment management and one of the most manual and complex parts of back-office operations. The lack of uniformity and standards makes it difficult to identify and interpret information correctly. Obtaining accurate and timely information is challenging, and errors can result in painful financial losses. The XigniteGlobalCorporateActions is the first cloud-based REST API to eliminate the pains and complexity caused by legacy data feed and files. The API provides a single-source data stream with consistent information gathered from more than 190 exchanges and over 30,000 U.S. mutual funds.

The recent split of TSLA and AAPL stock on the same day illustrates the complex and far-reaching impact of corporate actions. If a firm does not do this correctly, it will show on historical charts, and their customers will notice. Xignite’s Data Quality team cross-validates our corporate actions data across sources and proactively detects and fixes any missing information preventing missing issues such as the TSLA and AAPL splits.

Recommended AI News: Kore.ai Launches SmartAssist in Japanese to Deliver AI-powered Call Center Automation

“The industry is facing a perfect storm,” says Vijay Choudhary, Vice President of Product Management for Xignite. “On one hand, you have a massive wave of corporate actions fueled by the pandemic and the rising markets, and on the other, you have millions of new retail investors eyeballing their investment applications all day long. One bad corporate action can send your customer service department into a tailspin,” added Choudhary. Additional detail on the Corporate Actions API endpoints:

- GetDistributions – Returns cash and stock dividends as declared by the company for a requested security and date range.

- GetDistributionsByExchange – Returns cash and stock dividends as declared by the company for a requested exchange and date.

- GetEventSummaries – Provides a high-level overview of events for a requested security and date range.

- GetMergers – Returns merger events for a given identifier and date range.

- GetSpinoffs – Returns spinoff events for a given identifier and date range.

- GetSplits – Returns the stock split history for a security for a specified date range.

- GetTakeovers – Returns takeover events for a given identifier and date range.

Recommended AI News: Sales Tech Adoption Key to Keeping Pace with Virtual Selling Trends

Comments are closed.