Top Key Takeaways From The Visa FY23 Report

Well, Visa Inc. needs no introduction today. So, Let’s start with its ever-fascinating and much-awaited annual report which it publishes at year-end. In this special blog, we shall be talking about its report of 2023 in a summarised form since the original report consists of 133 pages which a layman could find pretty difficult to read and spend so much time on.

AiThority.com has simplified the findings from the report for our readers, investigating 133 pages into 2 pages in a nutshell. Here are the key takeaways from the Visa FY23 Report.

Visa- FY23 Performance

More than 130 million merchant locations, 4.3 billion payment credentials, 14,500 financial institutions, and over 200 nations and territories are all part of Visa’s network today. Over their fiscal year 2023, the Visa network processed 276 billion transactions, totaling $15 trillion in volume.

A lot happened in fiscal year 2023. In the wake of the COVID-19 pandemic, the economy has continued to grow, and technology has been advancing at a dizzying rate. One such innovation is generative artificial intelligence (AI), which promises to revolutionize our daily lives, the way we do business, and the way we shop, buy, and pay. Throughout it all, Visa was there, making sure our clients, partners, and stockholders got what they needed while also playing a crucial role in global payments.

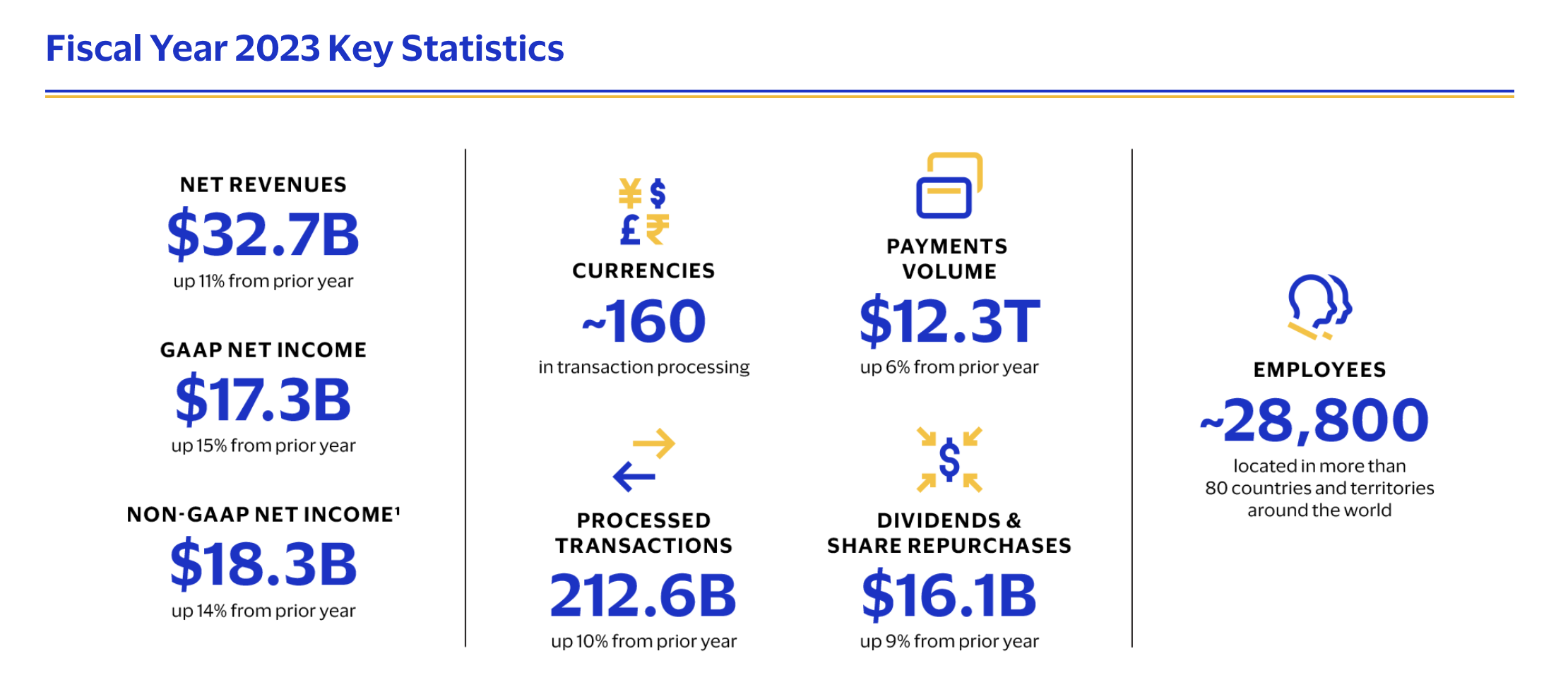

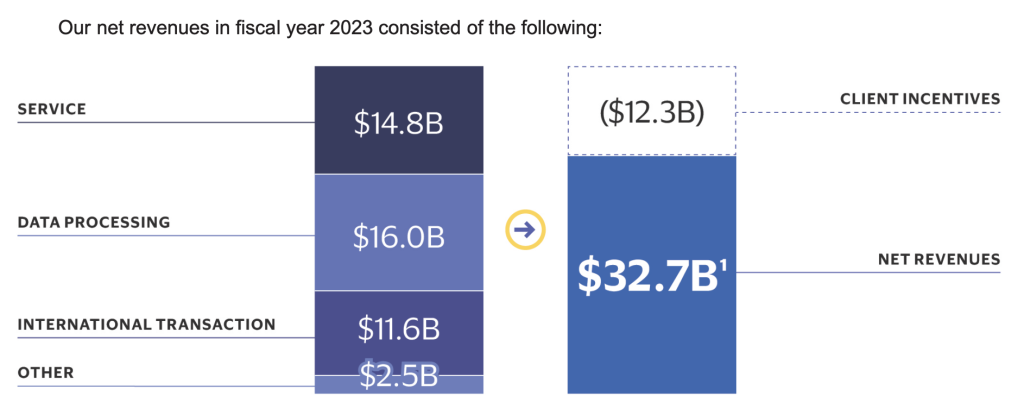

Despite widespread uncertainty in the macroeconomic climate, FY23 was another year of solid financial success. We achieved a 33% increase in net revenues to $33 billion and an 18% increase in GAAP profits per share to $8.28 as a result of our efforts to drive widespread growth in payments volume, processed transactions, and cross-border volume. Global consumer spending was strong, and the travel industry’s steady rebound kept cross-border volume growth rolling.

Read: State Of AI In 2024 In The Top 5 Industries

My Key Takeaways From The Visa FY23 Report

- Consumer payments

This figure includes both cash and payment transactions. Latin America, Central Europe, the Middle East, and Africa all had robust growth, contributing to a 17% increase to over 130 million merchant locations. From startup to established, they inked over 500 business collaborations with fintechs throughout the world. Lastly, outside of the US, tap-to-pay transactions accounted for 76% of all face-to-face transactions, a 9 percentage point increase from 63% of all face-to-face transactions worldwide.

Read: The Beauty Of AI In The Wood Industry

- New flows

New flows provide a great opportunity to expand and allow more payment use cases for our clients and partners. Small company and corporate card issuance accounted for most of the $1.57 trillion in commercial payments volume last year. Their Visa B2B Connect network helps businesses make large-ticket cross-border B2B payments by reducing friction, adding rich data, and tracking payments in the process. They added over 70% more banks to Visa B2B Connect in FY23, and the number of transacting banks doubled as clients engaged in the service.

Read: Top 10 Benefits Of AI In The Real Estate Industry

Visa Direct, our push payment technology, enables our new flow growth plan by allowing near-real-time P2P, B2B, business-to-consumer, and government-to-consumer financial transfers. Visa Direct expands its reach, adds capabilities, and drives acceptance across markets and categories. Visa Direct may access over 8.5 billion cards, bank accounts, and digital wallets worldwide. With over 500 enablers, we processed over 7.5 billion Visa Direct transactions in FY23 across 65 use cases and 2,800 initiatives. One promising use case is cross-border transfers. Cross-border P2P transactions increased 65% this year, setting a Visa Direct payments volume record in the fourth quarter. They are enthusiastic about Visa Direct’s progress and will continue to grow existing use cases, expand into new markets, and deepen their partner involvement.

- Value Added services

Their third growth driver is value-added services, which help clients and partners improve performance, differentiate their offers, and improve customer experiences. They estimate they generated $3 billion in customer revenue from over 2,000 consultancy engagements in FY23. Their value-added services growth strategy is to enhance client penetration of existing products, expand regionally, and innovate and launch new solutions. Over the last year, they improved in all these categories. Their top 265 consumers utilize 22 Visa services, twice as many as their typical clients.

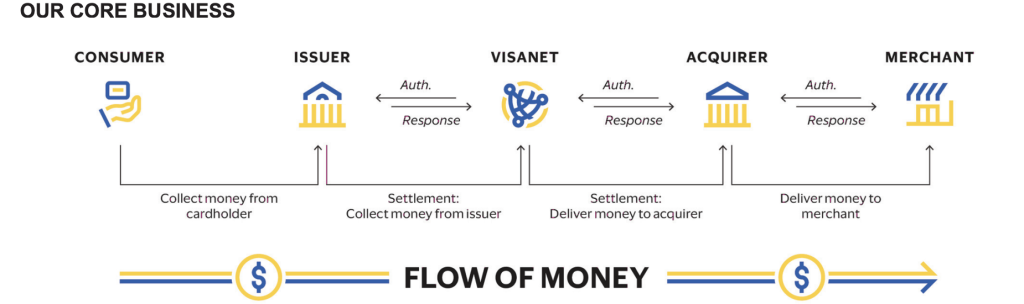

- Four-Party Model

With the ever-changing payments environment, Visa has expanded this model to encompass digital wallets, digital banks, and various fintechs, as well as governments and NGOs. Through VisaNet, they provide our merchant and financial institution clients with transaction processing services, mainly focusing on authorization, clearing, and settlement. Visa or other networks completed 276 billion payments and cash transactions carrying the Visa name in fiscal year 2023, which works out to 757 million transactions daily on average. The overall number of transactions processed by Visa was 213 billion out of 276 billion.

Read: 4 Common Myths Related To Women In The Workplace

- Partnership Approach

By delivering their technological capabilities through application programming interfaces (APIs), they embrace an open collaboration approach and aim to deliver value by facilitating access to their worldwide network. They work with established and up-and-coming companies to improve and broaden the payments ecosystem, which helps them leverage their platform’s resources for faster and more efficient company growth.

![]() Tokenization

Tokenization

The Visa Token Service (VTS) is a trust-building platform for innovations in digital commerce. With the rise of digital transactions, VTS aims to improve the digital ecosystem by enhancing authorization, reducing fraud, and enhancing the user experience. VTS aids in the security of digital transactions by substituting a token including a surrogate account number, cryptographic information, and other data for the traditional 16-digit Visa account number. Many different types of in-person and online monetary transactions are compatible with this security system. The distribution of tokens for use in the network is moving at a rapid pace. Greater than the number of physical cards in circulation, Visa has provided over 7.5 billion network tokens by the end of the fiscal year 2023. This major achievement further demonstrates Visa’s dedication to the safe, dependable, and fast transfer of funds both in-person and online.

- Mergers and Acquisitions, Joint Ventures and Strategic Investments

Visa is always looking for new ways to improve its offerings and provide our customers with more. Aligning with Visa’s aims, they supplement internal development via mergers and acquisitions, joint ventures, and strategic investments; these also deepen existing alliances. Before approving an acquisition, joint venture, or investment, Visa conducts a thorough business investigation to guarantee it will enhance its network, create value, and speed up its development. It acquired Pismo, a cloud-native platform for core banking and issuer processing with operations in Europe, Asia Pacific, and Latin America, in fiscal year 2023. All necessary governmental evaluations and approvals, as well as the usual closing conditions, must be satisfied before the deal may close.

[To share your insights with us, please write to sghosh@martechseries.com]

Tokenization

Tokenization

Comments are closed.