Is Your Financial Institution Navigating Its Digital Transformation With a Compass or a Rubber Chicken?

![]() Is your financial institution navigating its digital transformation with a compass or a rubber chicken?

Is your financial institution navigating its digital transformation with a compass or a rubber chicken?

In the ever-evolving finance jungle, traditional players face the daunting task of battling Fintech giants like Chime and Cash App (no longer the underdog challengers) and jostling with Mega Banks like Chase, who seem to have a yearly budget bigger than a blockbuster movie—way bigger, Jeez, $15B annually…

The relentless pressure from Fintech compels banks and credit unions to accelerate into a mobile-first philosophy, catering to the expectations of customers seeking convenient and personalized banking solutions. Millennials, known for their preference for brands with mobile customer service, play a pivotal role in steering this digital transformation.

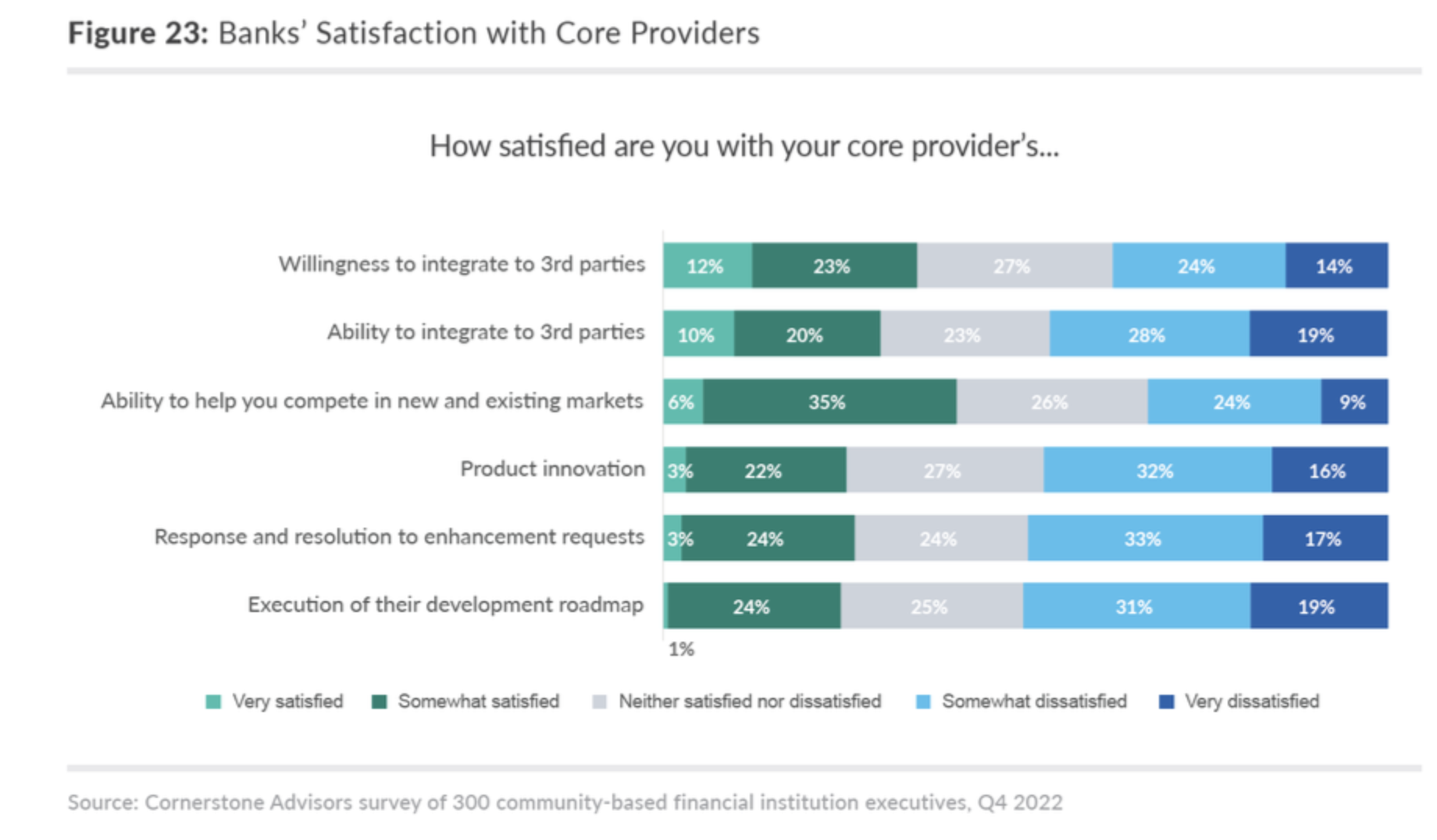

Recognizing the urgency, legacy financial institutions grapple with the challenge of keeping pace with their existing core providers. A survey by Cornerstone Advisors reveals stark statistics – only 30% of bankers express satisfaction with their core provider’s ability to integrate third parties, and a mere 25% are content with product innovation (Cornerstone Advisors – What’s Going on in Banking 2023 – survey of 300 community-based financial institution executives).

GenAI Experts Series Part 1: Building Brand in the Age of AI

However, faced with the challenges of maintaining pace with existing core providers, community banks and credit unions are discovering a promising solution to propel their digital journey forward: the Modular Banking strategy. This strategy offers theoretical flexibility, enabling legacy institutions to compete with Fintech without undergoing a complete core overhaul. It opens doors to accessing or building marketplaces of financial products and features, fostering product diversity, and providing effective services to niche customer segments.

However, faced with the challenges of maintaining pace with existing core providers, community banks and credit unions are discovering a promising solution to propel their digital journey forward: the Modular Banking strategy. This strategy offers theoretical flexibility, enabling legacy institutions to compete with Fintech without undergoing a complete core overhaul. It opens doors to accessing or building marketplaces of financial products and features, fostering product diversity, and providing effective services to niche customer segments.

But wait, there’s a twist in the plot. Some core banking providers are chanting the ‘bank as a service’ and ’embedded fintech’ mantra, claiming they can slap on an API layer and call it a day. It’s akin to writing COBOL code for a cutting-edge spaceship – a mismatch that no amount of lipstick can conceal. An API layer may seem like a cosmetic enhancement, but it doesn’t address the inherent challenges of legacy systems. APIs sound fancy, but they come with issues like scalability hiccups, data segregation drama, and a multi-tenancy headache.

Enter the serverless revolution – not your grandma’s potluck, but a buffet for digital transformation. APIs and clouds are the side dishes; the main course is Microservices design. It’s like having a Lego set for your applications, where each piece (service) has its job, making your banking system more versatile than a Swiss Army knife. This involves developing applications as small, independent services, each dedicated to a specific business function. Microservices design empowers financial institutions as fintech to efficiently build specific use cases, facilitating rapid isolation and scaling of diverse financial services.

Top News of the Month: Qualtrics X4 Kicks Off in Salt Lake City — CEO Zig Serafin Demonstrates Next-gen of Experiences

Think of it this way: Banks, credit unions, and Fintech companies can now run the digital transformation marathon with microservices. Payment processing? Check. User authentication? Double-check. It’s not just about speed – it’s about agility, like a financial gymnast doing cartwheels. This not only accelerates development and access to specific use cases but also ensures regulatory compliance. The significance of microservices in creating a modular digital banking platform is evident, as services like account management can now operate independently, enabling swift updates and scaling without disrupting the entire system.

The digital transformation clock is ticking as the midnight hour approaches. Is your financial institution in control, or are you playing hide-and-seek in the server room? Time waits for no one.

Is your financial institution navigating its digital transformation with a compass or a rubber chicken?

Is your financial institution navigating its digital transformation with a compass or a rubber chicken?

Comments are closed.