An AI Use Case that Every Company Needs – Fixing Revenue and Margin Leakage

By: Alex Hoff is Chief Product Evangelist with Vendavo

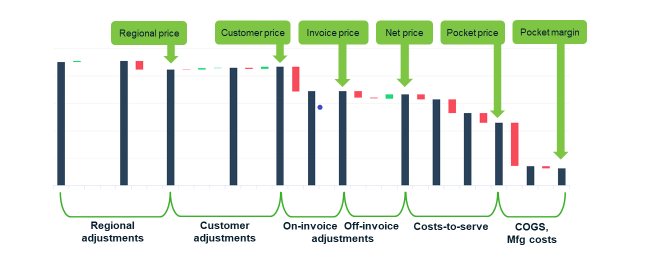

Ever since the 1990s when McKinsey & Company introduced executives to the concept of the pocket-price waterfall chart, many company leaders have been aware of the concepts of revenue and margin leakage.

A price waterfall is a visualization that helps companies realize how much they are really pocketing after every transaction. A series of influences can impact a product’s starting price or “list price.” Price discounts, rebates & incentives, free or discounted freight & delivery charges, warranties, and even payment terms costs are just a few points on the extensive list of on- and off-invoice deductions often applied to purchases.

Also Read: More than 500 AI Models Run Optimized on Intel Core Ultra Processors

After accounting for all these potential adjustments (usually deductions), the “pocket price” can easily come to 20-30% less than the starting price or list price.

Traditionally a high-effort, high-reward task

Revenue or margin leakage applies to nearly every company in every industry, and yet it’s frequently overlooked or underutilized as a source of generating top-line and bottom-line growth. One key challenge preventing many companies from doing this work is that the process of analyzing an enterprise’s sales transactions – at a detailed level – is a massive task. Many of my company’s clients have found millions or tens of millions of dollars in leakage that they were then able to recover and reclaim with our data structures and visualization tools. But in the end, this is still a human-driven process of searching for needles in a haystack.

With AI, we can now flip the script and have the AI find the needles for us, present them to us in logical fashion, and even recommend corrective actions.

How AI helps

AI is an ideal solution for detecting subtle patterns and anomalies that might indicate leakage.

Automated data analysis: AI can process and analyze vast amounts of data from various sources—such as sales transactions, contracts, and invoices—to identify variances and quantify their effects.

Diagnostic analytics: AI algorithms can detect situations where a customer is getting the large-volume discount, even though they’re buying at medium volume levels. These customers can be flagged for further review & validation and could even show up as an alert the next time the account manager reviews their contract for renewal.

Predictive analytics: AI can also use historical data to predict where future leakage might occur. By analyzing trends and patterns, AI can identify areas of the business that are most at risk of leakage, allowing companies to take proactive measures to address potential issues before they result in more significant losses.

Anomaly detection: One of the strengths of AI is its ability to identify outliers and anomalies in data that may be indicative of leakage. For example, AI can analyze sales data to detect unusual discounting patterns, or even changes in revenue or order frequency, that may be correlated with past account churn or defections.

Fixing revenue and margin leakage with AI

Identifying revenue and margin leakage is only the first step; fixing it is when the value becomes real. Once leakage sources are identified, AI can advise the business managers and point them to the specific tasks needed to prevent future leakage.

For example, AI can recommend adjustments to pricing / discounting, so that specific accounts can be put on a plan to move them more in-line with similar customers.

Another example is where AI can detect customers who are getting up-front discounts that are based on volumes they simply don’t purchase, and recommend the sales team offer them targeted, performance-based rebates or incentive programs instead.

Also Read: AiThority Interview with Dr. Arun Gururajan, Vice President, Research & Data Science, NetApp

Lastly, AI algorithms can identify cases where customers’ costs-to-serve are not supported by the appropriate charges or surcharges. A common occurrence is a customer getting ‘free’ expedited shipping on most of their orders, but only being charged for standard shipping. AI algorithms can be trained to detect these situations, quantify and prioritize them, and recommend corrective actions to fix the margin leakage.

Measuring / monetizing the impact of AI

The unique aspect of this AI use case is that, unlike many AI initiatives that are coming under more scrutiny, the case of revenue and margin leakage is one that can be tracked, measured and proven in clear terms. After leakage opportunities are identified and validated, the algorithms can use the specifics of each opportunity to track if the leakage was fixed, and by how much. By taking all these actionable opportunities and tracking their subsequent realization (or lack thereof), companies can confidently point to the millions of dollars in leakage they’ve recovered.

Revenue and margin leakage are like silent profit killers that can significantly impact a company’s bottom line if left unchecked. AI offers the opportunity to easily identify the most impactful sources of leakage, recommend corrective actions, and quantify the resulting improvements in revenues and margins.

[To share your insights with us as part of editorial or sponsored content, please write to psen@itechseries.com]

Comments are closed.