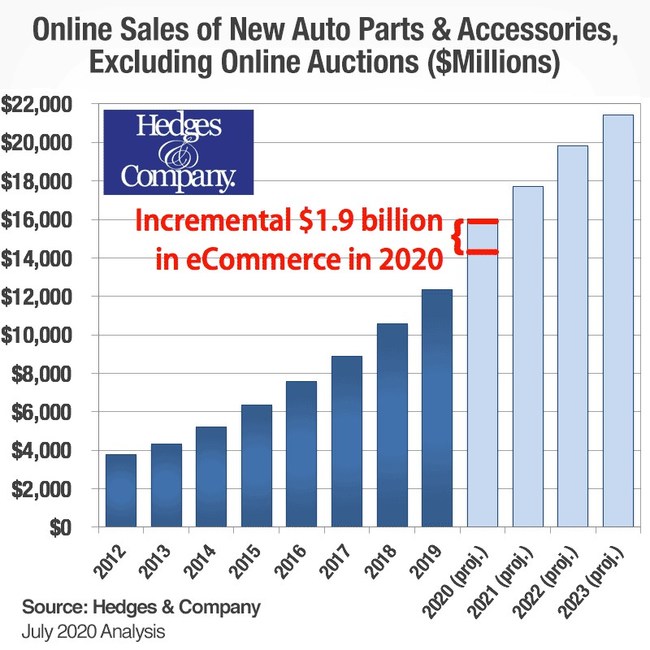

Auto Parts eCommerce Market Share Exceeding Original Forecast by Nearly $2 Billion

The 13th annual Hedges & Company eCommerce market share forecast for the US automotive aftermarket shows online revenue reaching $16 billion in 2020. This includes an incremental $1.9 billion in revenue due to the COVID-19 pandemic. A major trend during the pandemic, in nearly any industry, has been a dramatic shift to eCommerce market share. The original automotive forecast called for 2020 online shopping revenue at $14 billion but due to increased demand beginning in April, that forecast is now just over $16 billion.

Recommended AI News: Mavenlink Appoints Robert Pickell as CMO to Accelerate Global Marketing Strategy

This year’s new forecast projects new auto parts and accessories eCommerce revenue at over $22 billion by 2023.

Across North America, trends in online shopping for new auto parts and accessories are accelerating. North American automotive parts eCommerce is growing and is projected to reach US$20.6 billion in 2020. That includes CA$4.9 billion/US$3.7 billion in Canada and just under US$1 billion in Mexico.

Digital influence has a significant impact on both online and offline parts and accessories revenue. Digital influence occurs when a consumer does online research before buying an auto part or accessory. It comes from online advertising, reviews, “how-to” content, video advertising and video content. It has a significant impact because more than nine out of 10 shoppers do online research even if planning to buy in a retail store. Hedges & Company research shows consumers do most of their online research in four primary ways: online search (74% of all parts and accessories consumers); they look at auto parts retailer websites (73%); they visit manufacturer websites (57%) and read automotive forums (47%).

Recommended AI News: Oracle Inventory Optimization Enables Retailers to Navigate Uncharted Demand

In 2020, digital influence will impact the US auto parts retail industry by over $140 billion. This is down from $148 billion in digital influence in 2019. The drop can be attributed to the growth in eCommerce market share being offset with a reduction in brick and mortar retail sales in 2020. Digital influence is projected to rebound to $168 billion by 2023 in the United States.

Auto parts eCommerce market share transacted on mobile phones will account for $10.4 billion revenue in the US in 2020. That’s about a 40% increase over 2019, when mobile reached $7.4 billion.

The Hedges & Company annual forecast includes trends in online shopping for new and re-manufactured parts and accessories. This includes specialty equipment parts and accessories manufactured and distributed by SEMA-member companies. It also includes OEM replacement parts manufactured and distributed by members of the Auto Care Association and AASA.

Recommended AI News: Craft Academy Partners with Cybint to Launch Sweden’s First Cybersecurity Bootcamp

Comments are closed.