Patenting Trends of Artificial Intelligence Inventions in the US and Abroad

Canon, a global leader in image-related technologies, leads the worldwide list of top AI-patenting assignees with about 2% of total filings (top-most), about 2% of active granted patents (2nd most), and about 2% of pending applications (top-most)

Artificial Intelligence (AI) has expanded through many aspects of everyday life and the global economy. This is partly driven by AI’s proven ability to speed up and more accurately analyze large amounts of data, its potential to automate certain functions and routine tasks, its ability to improve operational efficiency, and its aptitude for helping mitigate waste and fraud. To better understand overarching IP trends, this article looks at the USPTO dataset paired with a traditional keyword search to analyze patenting trends in AI inventions.

Analysis Background of the Latest AI Patenting Trends

Funding for AI innovations is increasing in both the private and public sectors in the United States (US) and beyond. Worldwide, funding for AI startups has increased dramatically, from USD 670 million in 2011 to around USD 36 billion in 2020, and USD 77.5 billion in 2021, according to a report from Tortoise Intelligence. According to Crunchbase, private venture capital (VC) funding for the technology underlying OpenAI (a single funding event) of USD 10 billion represented a significant 13% of all global VC funding in Q1 2023, irrespective of the type of technology or company being funded.

As funding for specific technologies increases, research and development (R&D) and the filing for related intellectual property (IP) usually see compensatory increases as well. The massive growth of AI and related technologies (and the importance of understanding who the stakeholders and IP creators driving the AI movement are) is not lost on leadership at the United States Patent and Trademark Office (USPTO). They’ve spent significant time and effort creating examination guidelines related to AI-relevant US patent filings, as well as on additional project work to help assist government and industry policymakers and citizens in building an understanding of the overall IP landscape relevant to all things AI-related.

Grammarly Defies the AI Hype With Significant Business Impact, Deepens AI Support for Enterprises

A particular USPTO effort has resulted in the creation of a database of US-only patents and published applications relating to several AI technology subsets, which can be found at the USPTO’s Research Datasets site. The database is unique in that it was created using machine learning techniques (in essence, AI was utilized to find AI-related patents). To look at both US and global trends in AI patenting, this article examined the USPTO dataset as a baseline to understand overarching IP trends and then conducted a more traditional keyword search to create a complementary database of AI-related patent assets to analyze patenting trends in the AI space globally.

The USPTO created its database of US patents and published applications relating to eight specific AI technology components through a project undertaken by the Office of the Chief Economist (OCE). The project team landed upon the eight technology subsets based on a framework proposed in 2018 by Google staffers Aaron Abood (Senior Patent Counsel) and Dave Feltenberger (Senior Staff Software Engineer). The USPTO database identified over 2.1 million US patents and published applications from 1979 through February 2019 relating to machine learning, natural language processing, computer vision, speech, knowledge processing, AI hardware, evolutionary computation, and planning and control. This number reduces to about 1.6 million matters when published applications that have subsequently been granted (and those grants publish their standalone equivalents to their earlier-published applications) are removed.

Methodology to Study AI Patenting Trends

Because the USPTO database is through February 2019, this piece is informed by eight individual, complementary search strings to append the USPTO database to cover published applications and granted patents that met the AI search criteria and entered the USPTO publication corpus from March 1, 2019, through December 31, 2021. These complementary search strings were also what allowed the expansion of the original USPTO dataset to include those matters that are being filed and granted all over the world. As explained in detail in their 2021 J. Technol. Trans. article, the USPTO database authors utilized both searching techniques and machine learning algorithms for each of the eight AI technologies investigated [Giczy, A.V., Pairolero, N.A. & Toole, A.A. Identifying artificial intelligence (AI) invention: a novel AI patent dataset. J Technol Transf (2021)]. Their article provides deeper details regarding the methodology utilized around their searching and machine learning algorithms.

This analysis updates the USPTO team’s searching methodology to prepare updated search strings that adapted the traditional searching portion of their process, to create a comprehensive, yet focused, new set of strings that were then executed in our search and analytics software (to approximate their AI-based search), to append to the original database through December 31, 2021. This newly appended US-only dataset subsequently included over 2.4 million US patents and published applications, which were reduced to about 1.8 million when duplicative published applications were removed in favor of the granted patent. Statistics and trends were reviewed using the appended US-only dataset after the duplicative published applications with granted equivalents were removed.

The queries were then expanded outside of the US utilizing AcclaimIP, to build a worldwide AI-related dataset that could be then analyzed for trending and educational purposes (made up of over 9 million worldwide patent matters).

Top News: LLM-powered EUREKA Co-pilots Zero Shot Reward Generation

Key Findings

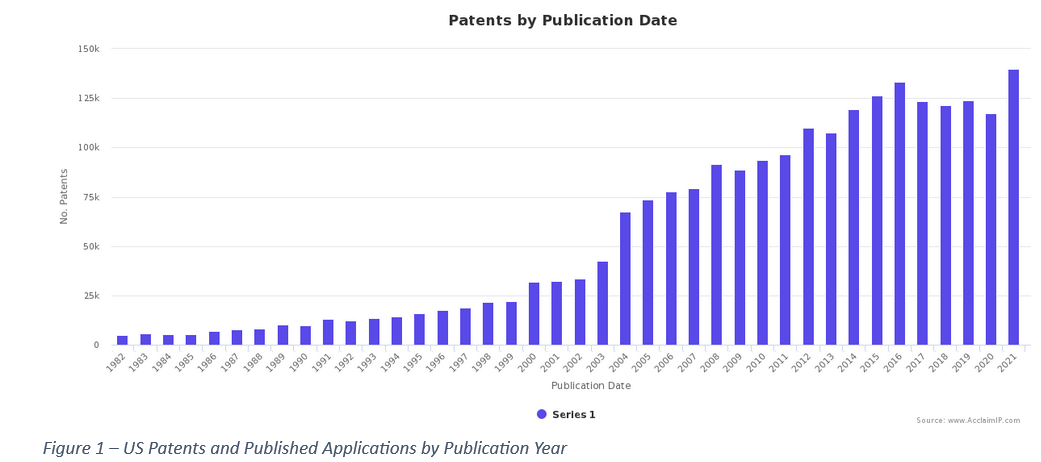

According to the data analyzed by our AcclaimIP, US patent publications steadily increased through the mid-2000s, then dropped slightly before picking back up in the early- to mid-2010s (see Figure 1). The late-2010s have shown a leveling off of AI-related patent publications.

It is important to note that matters published in 2020 and 2021 were the result of research and patent applications that were submitted to the USPTO before the start of the COVID-19 pandemic as the USPTO keeps applications confidential for 18 months after submission. Therefore, any effect the pandemic may have had on AI-related research and patenting activity won’t be known until publications in 2022 and beyond are released.

Table 1 notes the top ten assignees within the Expanded US-only USPTO Database, with the percentage of matters for each assignee shown for each type of patenting activity. The top ten assignees account for about 17% of total matters, about 16% of still-active granted patents, and about 10% of actively pending applications in the eight AI technologies of the Appended USPTO Database. The top 100 assignees account for about 44% of total matters, about 45% of still-active granted patents, and about 33% of actively pending applications in the eight AI technologies. When looking at worldwide patent assets outside of the US, the top 100 assignees account for a smaller proportion of the dataset; about 28% of total matters, about 34% of active granted patents, and about 34% of actively pending applications (see Table 2).

Table 1 notes the top ten assignees within the Expanded US-only USPTO Database, with the percentage of matters for each assignee shown for each type of patenting activity. The top ten assignees account for about 17% of total matters, about 16% of still-active granted patents, and about 10% of actively pending applications in the eight AI technologies of the Appended USPTO Database. The top 100 assignees account for about 44% of total matters, about 45% of still-active granted patents, and about 33% of actively pending applications in the eight AI technologies. When looking at worldwide patent assets outside of the US, the top 100 assignees account for a smaller proportion of the dataset; about 28% of total matters, about 34% of active granted patents, and about 34% of actively pending applications (see Table 2).

Similarly, the top ten assignees in worldwide patent assets account for significantly lower percentages in each of the three types of patenting activity as compared to the Expanded US-only USPTO Database (11% for all matter types, 11% for active grants, and 12% for actively pending applications). This may indicate that AI technologies, or at least their related patenting activities, are concentrated in fewer, larger companies in the US versus the rest of the world, with parity between the two datasets just now being seen via those matters that have more recently been filed (and are therefore still actively pending/going through patent office examination at the time of writing of this article; i.e. the top 100 assignees of this matter type making up about a third of the total in both the US and worldwide).

Table 1 – Top Ten Assignees of US Matters by Matter Type

| Total US Matters | % of Total | Active US Grants Only | % of Total | Pending US Apps Only | % of Total |

| IBM | 4.11% | MICROSOFT CORP | 2.75% | IBM | 1.69% |

| MICROSOFT CORP | 2.66% | ALPHABET INC | 2.34% | INTEL CORP | 1.34% |

| SAMSUNG ELECTRONICS | 1.79% | SAMSUNG ELECTRONICS | 2.22% | PHILIPS ELECTRONICS NV | 1.26% |

| ALPHABET INC | 1.44% | IBM | 2.10% | SAMSUNG ELECTRONICS | 1.07% |

| SONY CORP | 1.39% | APPLE INC | 1.43% | MICROSOFT CORP | 0.91% |

| CANON KK | 1.30% | ORACLE INT CORP | 1.28% | UNIV CALIFORNIA | 0.85% |

| INTEL CORP | 1.23% | SONY CORP | 1.15% | TOYOTA MOTOR | 0.83% |

| APPLE INC | 0.91% | AMAZON TECH INC | 1.04% | ALPHABET INC | 0.82% |

| ORACLE INT CORP | 0.89% | CANON KK | 0.97% | SONY CORP | 0.79% |

| HITACHI LTD | 0.85% | SAP SE | 0.93% | TOKYO ELECTRON LTD | 0.74% |

Table 2 – Top Ten Assignees of Worldwide Matters by Matter Type

| Total Worldwide Matters | % of Total | Worldwide Active Grants | % of Total | Worldwide Pending Apps | % of Total |

| CANON KK | 1.62% | THE GOVERNMENT OF CHINA | 2.73% | CANON KK | 2.13% |

| PANASONIC CORP | 1.36% | CANON KK | 1.65% | SAMSUNG ELECTRONICS | 1.70% |

| SAMSUNG ELECTRONICS | 1.14% | SAMSUNG ELECTRONICS | 1.27% | THE GOVERNMENT OF CHINA | 1.31% |

| SONY CORP | 1.11% | HUAWEI INVESTMENT & HOLDING CO | 1.15% | PANASONIC CORP | 1.05% |

| HITACHI LTD | 1.09% | STATE GRID CORP CHINA | 1.09% | SONY CORP | 1.02% |

| THE GOVERNMENT OF CHINA | 1.07% | LG CORP | 0.87% | QUALCOMM INC | 0.94% |

| TOSHIBA CORP | 0.96% | FUJIFILM CORP | 0.76% | STATE GRID CORP CHINA | 0.89% |

| NEC CORP | 0.95% | SONY CORP | 0.73% | HITACHI LTD | 0.86% |

| FUJITSU LTD | 0.79% | HITACHI LTD | 0.70% | RICOH CO | 0.84% |

| FUJIFILM CORP | 0.71% | MICROSOFT CORP | 0.67% | FUJIFILM CORP | 0.84% |

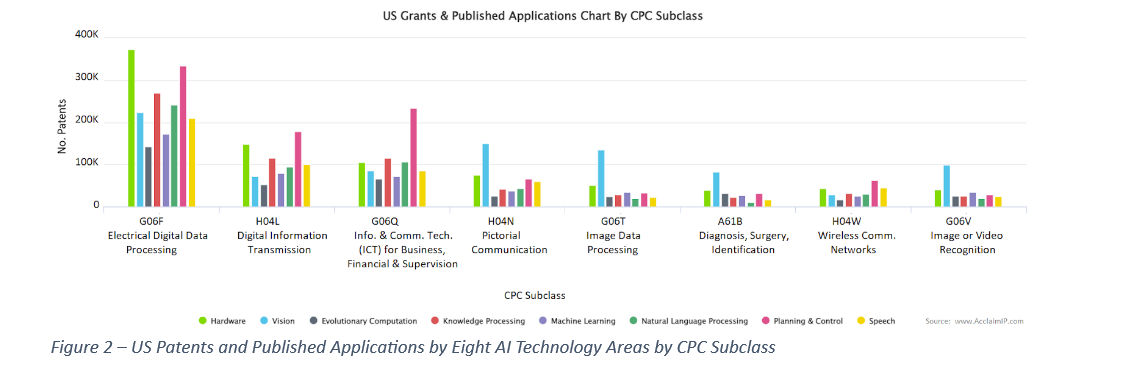

Given the eight AI technologies of the Appended USPTO Database, it’s not surprising that computer engineering and software companies lead the assignee ranks, or that the Cooperative Patent Classification (CPC) of “electrical digital data processing” (CPC subclass “G06F”) is the primary inventive technology classification assigned to most AI-related matters (see Figure 2). The CPC is a taxonomy-based classification system used by patent offices worldwide for the categorization and internal management of incoming patent applications and is used extensively for data analysis purposes by analysts both inside and outside of the various patent offices.

A deeper look into each of the eight AI technologies grouped by CPC subclass shows that each technology area is reasonably represented within the broad computing “electrical digital data processing” subclass. As would be expected, the AI vision technology area dominates the “pictorial communication”, “image data processing”, and “image or video recognition” subclasses. Within the AI vision technology area in particular, IBM, Microsoft, and Samsung are still the three most active assignees (as they are overall with AI-related US matters of all types; Table 1), where they cumulatively account for over 8% of total filings, active granted patents, and pending applications. Vision-related matters make up about 27% of all categorized matters of the 1.8 million US record dataset.

It’s also not surprising that Canon, a global leader in image-related technologies, leads the worldwide list of top AI-patenting assignees with about 2% of total filings (top-most), about 2% of active granted patents (2nd most), and about 2% of pending applications (top-most), as was seen in Table 2. Although the 9 million worldwide matters weren’t graphed related to the eight AI technologies by CPC subclass like the US matters were in Figure 2, vision-related matters make up about 25% of all categorized matters of the 9 million worldwide record dataset.

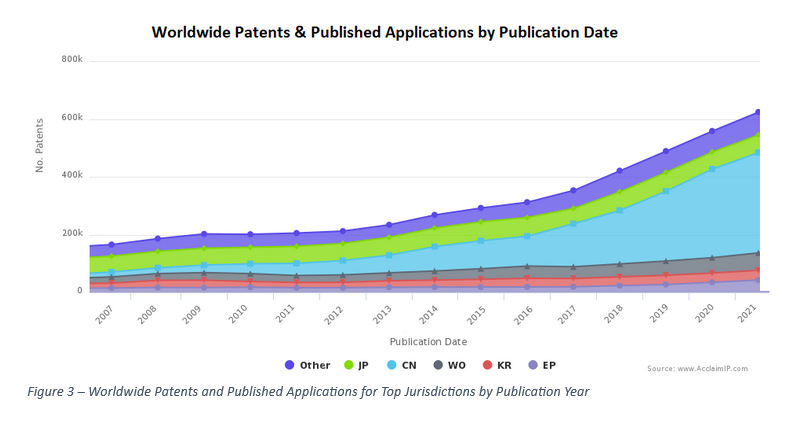

Outside of the US, overall patent application filings are up worldwide (see Figure 3), with a steadily increasing trend seen especially over the past decade. However, looking at filings in specific jurisdictions, some interesting trends emerge. Most jurisdictions, including South Korea, Europe, and the Patent Cooperation Treaty (PCT; “WO” in Fig. 3; an application-only treaty organization that allows for subsequent granting of patent claims in countries all over the world), show a steady level of filings over the past fifteen years.

Outside of the US, overall patent application filings are up worldwide (see Figure 3), with a steadily increasing trend seen especially over the past decade. However, looking at filings in specific jurisdictions, some interesting trends emerge. Most jurisdictions, including South Korea, Europe, and the Patent Cooperation Treaty (PCT; “WO” in Fig. 3; an application-only treaty organization that allows for subsequent granting of patent claims in countries all over the world), show a steady level of filings over the past fifteen years.

In contrast, patent filings in China and Japan have seen a significantly sharper increase over the past decade, as well as those jurisdictions represented by the “Other” category of Figure 3, which include Germany, Canada, Taiwan, Australia, India, and Russia.

In examining China, the percentage of utility model filings versus invention application filings for the AI-specific dataset in Figure 3 is notable as utility model filings are rapidly increasing in the country.

Utility model filings account for only about 23% of the total AI-related patent application filings in China, with invention filings making up the remaining 77% of the total. In contrast, for total filings published in China in 2021 (irrespective of the technology area of the filing), about 61% of patent application publications were utility model filings (versus 39% being filed as invention applications), a virtually opposite situation to the Chinese AI-related filings application-type breakdown. However, the noticeably lower percentage of utility model filings in the AI space in China is expected given the technological nature of AI innovations (i.e., that the technology is foundational and in need of the longer 20-year statutory patent term imparted by invention patents), versus the protection level and purpose of utility model applications (i.e., used for quick, product-based protection, having a lower level of patent office examiner scrutiny, but with a shorter ten-year-only patent term).

As funding for AI-related technologies and products grows, so do related government- and corporate-driven intellectual property protection efforts. In the past, AI-related patenting activities have been led by large multinational corporations, but smaller organizations are increasingly jumping on board, which aligns with more recent increases in AI startup funding. China is the fastest-growing jurisdiction worldwide for AI-related innovation patent protection, but the US and Japan still hold strong positions amongst globally recognized patent-issuing authorities.

As funding for AI-related technologies and products grows, so do related government- and corporate-driven intellectual property protection efforts. In the past, AI-related patenting activities have been led by large multinational corporations, but smaller organizations are increasingly jumping on board, which aligns with more recent increases in AI startup funding. China is the fastest-growing jurisdiction worldwide for AI-related innovation patent protection, but the US and Japan still hold strong positions amongst globally recognized patent-issuing authorities.

Finally, the data shows computing, calculating, measuring, and communicating are the top technologies where AI innovations are being pursued for patent protection.

However, AI’s influence appears to be moving into other technology sectors, such as medicine and image/voice-recognition technologies, with AI-based innovations in image-recognition technology becoming a particularly fast-growing focus for patenting. As more foundational AI innovations are rapidly developed, it’s expected that AI will continue to infiltrate other technology sectors that will inevitably touch every aspect of our daily lives.

Comments are closed.