10 AI ML In Banking And Finances Trends To Look Out For In 2024

With a CAGR of 32.6% between 2021 and 2030, the worldwide AI in the banking market is expected to expand from its 2020 valuation of $3.88 billion to a total of $64.03 billion.

Introduction to AI and its Potential in the Banking and Finance Industry

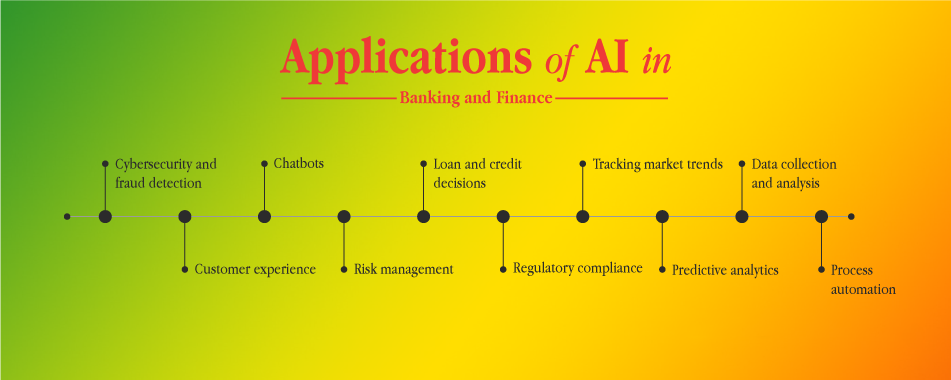

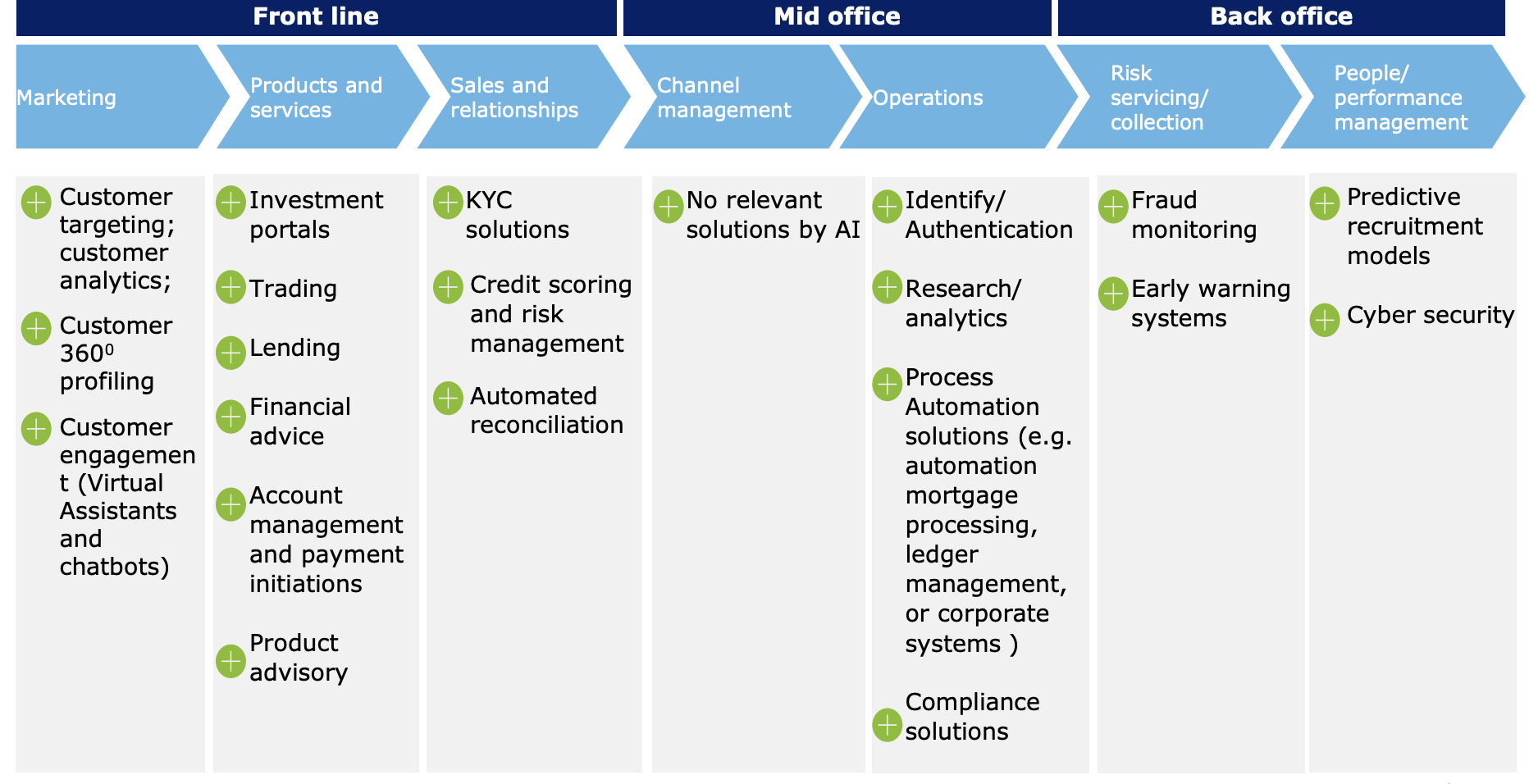

Artificial Intelligence has drastically changed banking and finance. Recently, AI technologies like machine learning and natural language processing have helped banks automate procedures, generate insights, and enhance client experiences.

Fraud detection and prevention are significant AI applications in banking and finance. AI systems can swiftly detect fraud in big transaction volumes. AI can also identify suspicious trends and abnormalities that may indicate fraud.

Customer service is another AI-powered banking application. AI-powered chatbots and virtual assistants may answer client questions and make data-driven suggestions. This helps banks enhance customer service and cut expenses.

Customer service is another AI-powered banking application. AI-powered chatbots and virtual assistants may answer client questions and make data-driven suggestions. This helps banks enhance customer service and cut expenses.

AI enhances banking risk management. Banks may anticipate and manage risks by examining consumer behavior, market trends, and economic indicators.

The banking and financial services sector has been drastically altered by the advent of AI. Automating procedures, gaining insights, and improving overall customer services are just some of the ways that banks and financial institutions have benefited from the development of artificial intelligence (AI) in recent years. AI has several uses in the banking and financial services industry, but one of the most important is its application in the identification and prevention of different types of fraud. AI systems can swiftly examine enormous numbers of transactions and identify fraudulent behavior. A further use for AI is in the detection of anomalies and out-of-the-ordinary patterns that might be suggestive of fraud.

Read: Top 15 AI Trends In 5G Technology

Customer service is another key area where AI has proven useful in the banking industry. Chatbots and virtual assistants powered by AI may answer customers’ questions and provide tailored suggestions based on their information. Financial firms may use this to boost customer satisfaction and cut expenses. Banking risk management is another area where AI is being put to good use. By examining data from different sources, including customer behavior, market trends, and economic indicators, banks may detect possible hazards and take proactive efforts to reduce them.

Customer service is another key area where AI has proven useful in the banking industry. Chatbots and virtual assistants powered by AI may answer customers’ questions and provide tailored suggestions based on their information. Financial firms may use this to boost customer satisfaction and cut expenses. Banking risk management is another area where AI is being put to good use. By examining data from different sources, including customer behavior, market trends, and economic indicators, banks may detect possible hazards and take proactive efforts to reduce them.

Overall, banking and financial services are just scratching the surface of what can be done using artificial intelligence. As its development proceeds, we anticipate increasingly sophisticated uses of AI in areas such as portfolio management, credit analysis, and regulatory compliance. AI in banking and financial services is still developing, with numerous prospects for innovation and development. As AI advances, investment management, loan underwriting, and compliance will become more advanced.

Read the Latest blog from us: AI And Cloud- The Perfect Match

What is ML in Finance?

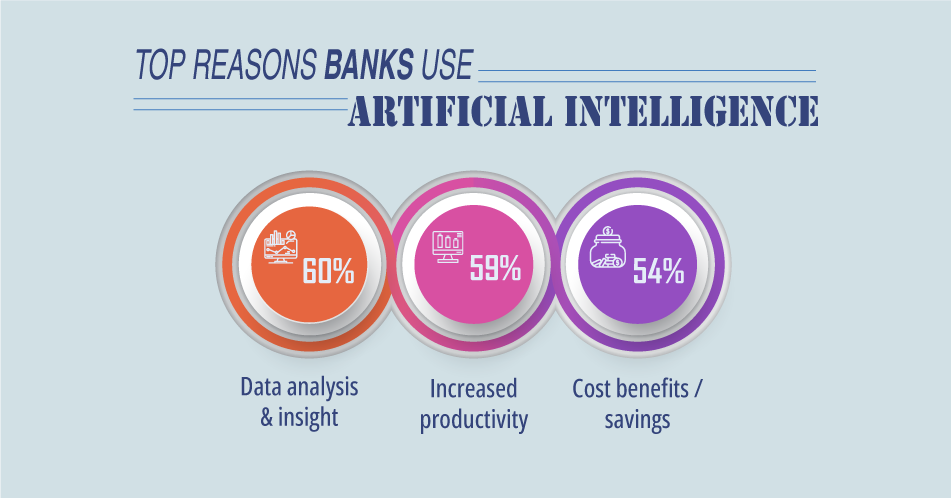

Machine learning (ML) is a branch of AI that allows computers to teach themselves new skills via the use of neural networks and deep learning without being given any specific instructions. It allows financial institutions to utilize the data to train models to address specific problems with ML algorithms – and give insights on how to improve them over time. The chart below has been picked up from the Deloitte source to add up the required spice.

10 AI ML In Banking And Finances Trends To Look Out For In 2024

Trend 1-Detect Anomalies

Companies’ asset-serving divisions struggle most with anomaly identification. Anomalies might originate from ordinary accidents or system defects. Fintech anomalies may be linked to illegal operations like account takeover, fraud, network infiltration, or money laundering, which might have unintended consequences. Anomaly detection may be solved via machine learning. Financial machine-learning anti-fraud systems can spot tiny user behavior patterns and correlations. It can analyze enormous databases and compare variables in real time to detect fraudulent transactions.

The use of RPA (Robotic Process Automation) enables AI to analyze and improve business procedures. This allows for the automation of around 80% of repetitive job procedures, freeing up time for knowledge workers to focus on value-add operations that demand a high degree of human engagement.

Trend 2-Portfolio Management Robo-Advisors

Online robo-advisors provide automated financial guidance. Their algorithms and data-driven portfolio management services develop and maintain clients’ investment portfolios.

Some people find investing scary, but internet investment platforms make it easier. These services are also much cheaper than financial advisors. Many have low or no account minimums. Online investing businesses Betterment and Wealthfront offer portfolio management and financial advice through their robo-advisors or mobile apps. Online financial advisers help consumers manage their finances using technology. Betterment recommends asset allocations to investors using algorithms.

Investor responses to “How do you plan to use the money?” and “What is your timeline? This conclusion is drawn.

Technology’s impersonality helps Wealthfront offer investing services. Its program executes proven investing techniques, automatically finds better investments, and maintains the appropriate investment mix. Nutmeg is a leading UK digital wealth manager. Based on financial goals and risk tolerance, the Nutmeg robo-advisor invests in a balanced portfolio.

Trend 3-Algorithmic Trading

Algorithmic trading allows large transactions by regularly sending “child orders” to the market. Hedge fund managers employ automated trading techniques and machine learning in finance. Traders might automate particular procedures to stay competitive. The technology also allows cross-market trade, improving possibilities. Machine learning algorithms’ real-time learning and response provide banking organizations with a competitive edge.

Trend 4-Chatbots and VAS

Consumers demand more conversational bank interactions. They want Amazon, Netflix, and Uber-like customer service. This is achievable in banking thanks to chatbots and virtual assistants. Consumers want better customer service from banks as well as other sectors. AI-powered chatbots and virtual assistants may advise users on bank account balances and other transactions 24/7. They can also allow conversational money transfers.

AI-powered chatbots merged with Natural Language Processing (NLP), connect and communicate with clients 24/7 and enhance online discussions. Chatbots may now do more than just respond to common client inquiries about their accounts; they can also assist with tasks like creating new accounts and routing complaints to the proper departments.

Trend 5-Underwriting based on ML

If a consumer has no bank credit history, it might not be very reassuring to assess their creditworthiness. Big data and ML examine 10,000+ data points to determine creditworthiness. It allows pre-approval of l**** for a wide range of consumers, including students and self-employed people.

In corporate lending, AI-based underwriting may simplify the complicated process, assess market patterns, detect loan risks, future behavior, fraud likelihood, etc.

This brief movie introduces HALO, our AI/ML analytics platform for data-driven automated credit decisions for banks and financial organizations. Lenders can save credit costs by enhancing loan disbursals with HALO. Explore HALO, the realm of AI-powered lending.

Read: AI and Machine Learning Are Changing Business Forever

Trend 6- Personalized Banking

Personalization is AI and Machine Learning’s largest value. Based on spending patterns, savings and investment objectives, health insurance portfolios, and other characteristics, a future bank should deliver insights, alerts, and suggestions suited to an individual’s financial goals. AI is still developing and being implemented in banking. Some banks use predictive analytics to estimate consumer financial demands.

Before offering personalized services, banks must know how clients want to be addressed. Lots of work is needed. Banks need plenty of fragmented data from several systems and divisions. AI must be used to mine this data and provide customers with relevant insights and guidance.

Trend 7- Cybersecurity and AML

Innovative AI and machine learning integration into banking will improve security in the future. The financial services industry can improve cybersecurity and anti-money laundering with AI and ML. Many banks use AI and ML to detect suspicious or anomalous money laundering transactions. In the approaching years, AI and ML will be used more. Integrating these technologies will streamline service, saving time, money, and personnel. It will also assist banks, corporations, and people in upgrading their security systems to avoid cyberattacks on their institutions, networks, and accounts.

By analyzing historical data on assaults and picking up correlations between seemingly unrelated indications, AI has the potential to greatly enhance the efficiency of cybersecurity systems. In addition to mitigating external risks, AI may also monitor internal threats or breaches and recommend remedial steps, resulting in the avoidance of data theft or misuse.

Trend 8- Credit Score

Credit scoring may be ML’s biggest banking application. It determines a customer’s ability to pay and debt repayment intentions. Credit scoring solutions are needed since billions of people are unbanked and barely half qualify for credit. Work experience, income, transaction analysis, and credit history are some of the factors used in machine learning scoring.

This mathematical model uses statistical and accounting principles. Machine learning algorithms can create more accurate, sensitive, and personalized credit score evaluations, enabling more individuals to get credit. Human scorers cannot objectively rate debtors like machine learning algorithms. With machine learning in banking, organizations may eradicate gender, racial, and other conscious or unconscious prejudices and serve more people.

Since ML in credit scoring has several benefits, including the opportunity for users to request l**** in a few clicks from home, Document Processing, and Onboarding Document processing has traditionally been laborious. Machine learning accelerates document classification, tagging, and processing. OCR must be performed to copies before machine learning algorithms can analyze scanned documents’ text to establish context. This data helps the machine learning model classify and index everything for future use. Machine learning on paper forms can help traditional banks enroll new clients.

Read 10 AI In Manufacturing Trends To Look Out For In 2024

Trend 9- Better Investment Assessment

Investment valuation requires many complex calculations. The strategy involves collaborating with investment asset management teams, product specialists, and portfolio managers. These teams should consider investment options. ML can solve this problem by processing vast amounts of data from several sources in real time and learning risk tolerance, investment, and time horizon biases.

Trend 10- Customer Sentiment Analysis

Big data and machine learning have made client sentiment analysis a significant AI application for banks. Banks have a lot of unstructured consumer data, which computers can’t grasp. AI can interpret this data and get new insights. When a consumer phones the help desk with an issue, an AI system may detect their emotions in real time. This helps banks assess their staff’s problem-solving skills and take action if consumers aren’t satisfied. These technologies can analyze client feedback and social media remarks. Banks may use AI to forecast consumer reactions to events like the debut of a new product or service or market developments by recognizing trends in online customer reviews.

What’s Next for AI in Banking and Finance?

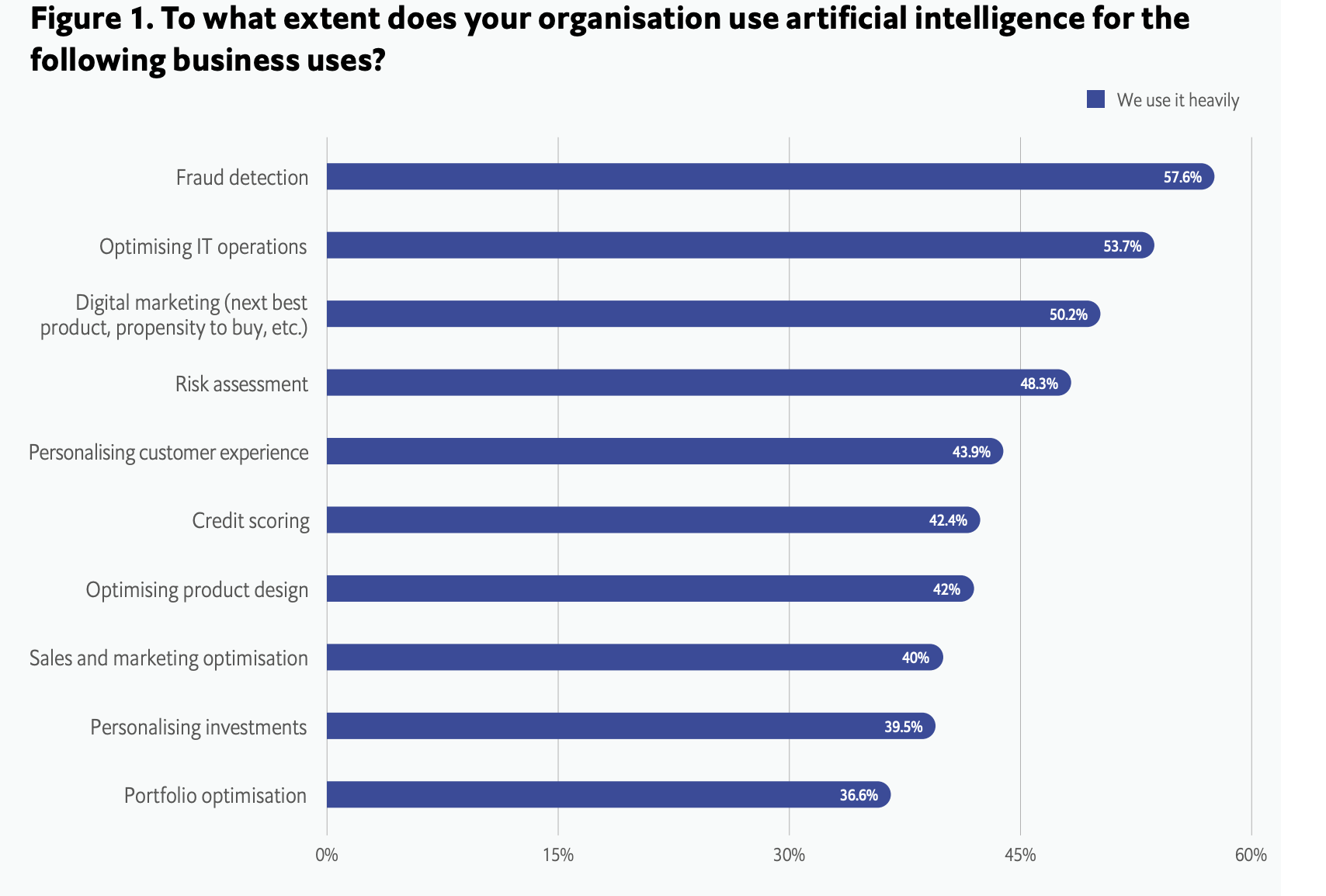

The chart below has been taken from The Economist which gives an overview of the successful adoption of AI and ML in organizations.

The development of the financial sector will be aided by AI. Many businesses now use digital methods, which have allowed them to increase sales, streamline operations, and concentrate on data. They’ll have to build up the level of individualization in their relationship-based client interaction going forward. Customized replies, safer and more responsible product and service suggestions, and expanding concierge services accessible at consumers’ beck and call all benefit greatly from AI’s involvement.

The development of the financial sector will be aided by AI. Many businesses now use digital methods, which have allowed them to increase sales, streamline operations, and concentrate on data. They’ll have to build up the level of individualization in their relationship-based client interaction going forward. Customized replies, safer and more responsible product and service suggestions, and expanding concierge services accessible at consumers’ beck and call all benefit greatly from AI’s involvement.

In addition, banks will have to create distinctive digital customer profiles based on customers’ permissions, although the information they require may be isolated in other databases. Financial institutions can scale effectively and meet the individualized demands of their consumers by eliminating silos, layering on AI, and employing human involvement seamlessly.

Although AI and ML are still in their infancy in banking, we may aspire for increased usage. Fortunately, financial institutions are recognizing the implications of AI and ML technology. However, most banks have restrictive systems that make technological transformation difficult. Banks must trust and utilize these technologies to overcome this.

[To share your insights with us, please write to sghosh@martechseries.com]

Comments are closed.