The Geneva Association: Growth of Cyber Insurance Market Should Not be Taken for Granted; Accumulation Risk a Key Concern

Cyber insurance offerings and premium volumes have expanded sizeably. Keeping up with demand is challenging and sustainable growth in the cyber insurance market should not be taken for granted, as accumulation risks need to be addressed in the context of a hyperconnected digital world.

Read More: Millennial Parents Feel More Secured about AI Babysitting their Generation Alpha Kids!

The study ‘Advancing Accumulation Risk Management in Cyber Insurance’, released by The Geneva Association, the leading international think tank of the insurance industry, identifies three prerequisites to ensure sustainability of cyber insurance. First, customers and insurers must facilitate resilience at the source of risk. Second, insurers need to make an acceptable return on capital. And third, available capital must absorb shocks from accumulation risks.

Anna Maria D’Hulster, Secretary General of The Geneva Association, said: “Expanding the boundaries of insurability is not new for insurers. However, cyber risks are taking us into uncharted territory. Both exposures and threats have distinct characteristics, bringing unprecedented challenges.”

Read More: Innovative AI to Help You Get to the Heart of Your Customers’ Needs

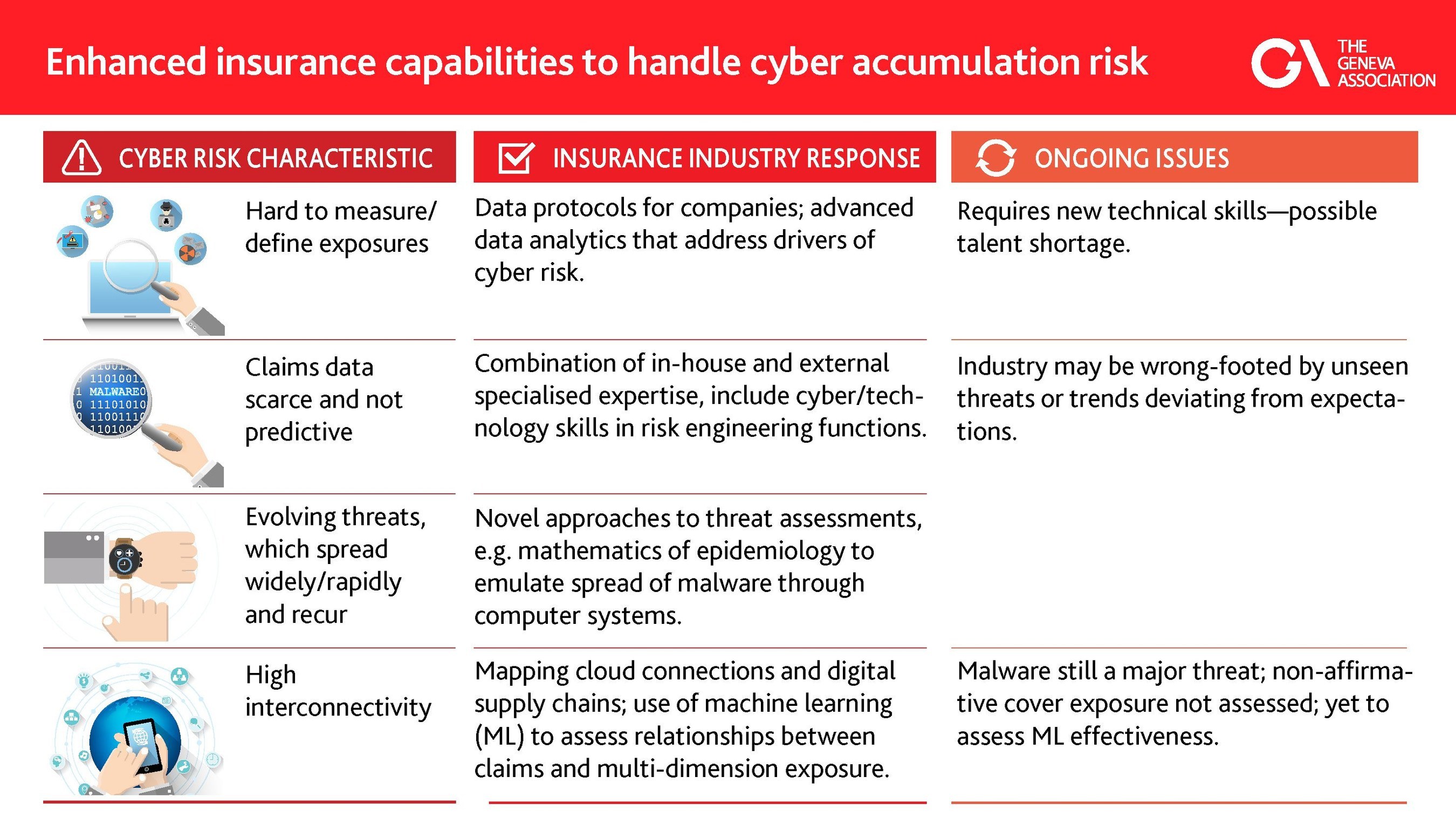

The report highlights four cyber accumulation risk challenges:

- A single large event or a series of consecutive events may make affirmative cyber insurance unprofitable

- Insurers and reinsurers could underestimate cyber exposures resulting in unplanned shocks from a major event

- Data of insufficient quality for more advanced modelling techniques

- Governments predominantly fail to provide frameworks for the sharing of cyberterrorism-induced losses

Read More: Seeing Machines Delivers Precision DMS Technology to OEM Companies

In response, insurers have developed several approaches:

- Developing data analytics that analyse the characteristics of cyber risk; as well as data protocols that combine company information with digital risk indicators.

- Novel approaches to analysing the risk ‘footprint’ and corresponding threats impacting the ‘size of the footprint.’ For example, applying the mathematics of epidemiology to the spread of computer viruses.

- Mapping cloud-related interconnectivity and digital supply chains, and using machine learning to assess the relationship between claims frequency and multi-dimension exposure.

Daniel Hofmann, Senior Advisor Insurance Economics at The Geneva Association and primary author, said: “Cyber risk has distinct characteristics. Exposure bases are hard to define and measure. Historical claims data are scarce and not good predictors. Threats are constantly evolving, can spread widely and rapidly, and a series of consecutive large events is plausible. Moreover, a high degree of interconnectivity may result in potentially boundless impacts.”

Read More: Oracle Retail Recognized as a Leader in Point of Service in Independent Research Report