Amazon Q3 Results: Reactions from Top Retail and Marketing Tech Experts

It’s been a mixed year for Amazon so far, and the latest Amazon Q3 revenue announcements might just dent the next quarter’s progression if the trend continues to buck. It has been reported that Amazon profits suffered its largest percentage drop in four years. Its third-quarter earnings fell to $3.2 billion compared with $3.6 billion last year. To understand why the revenues dropped for Amazon and what the future holds for the ecosystem, especially partners and merchants, we spoke to top technology experts.

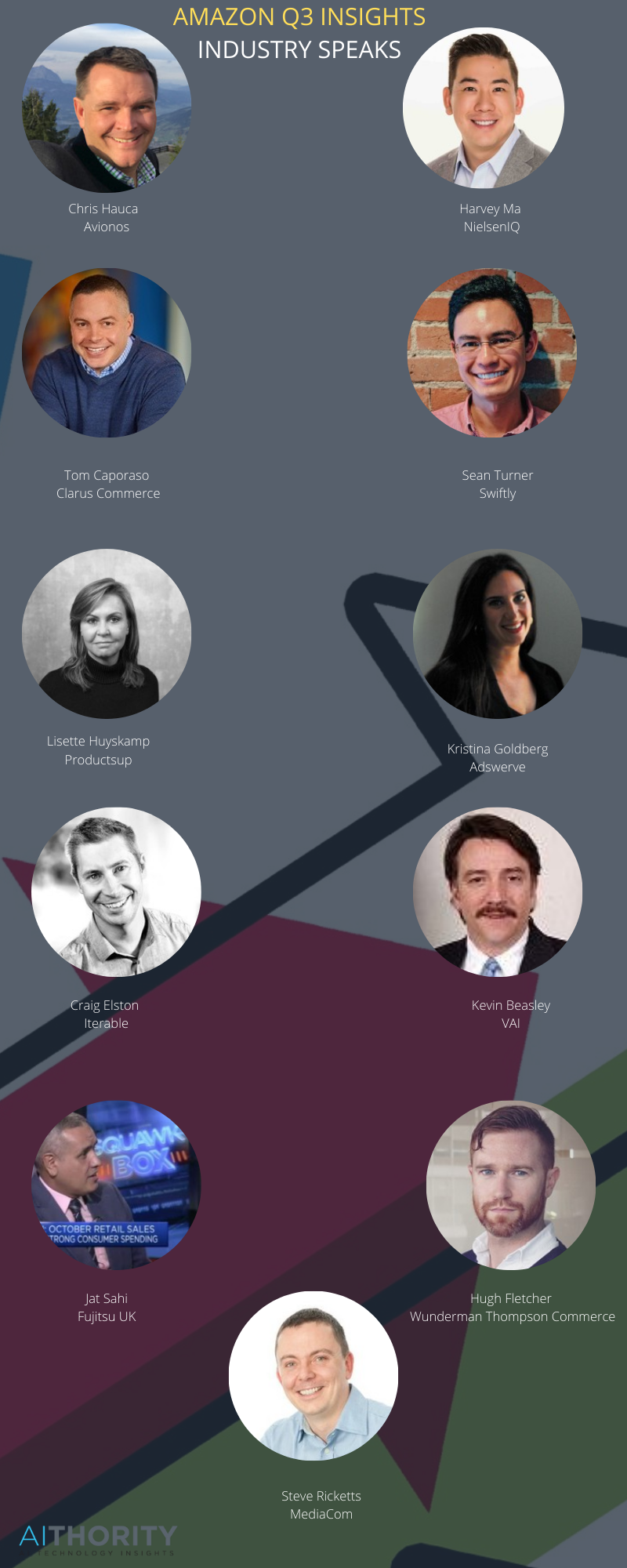

This is a featured story on Amazon Q3 revenue announcement, covering insights from the industry leaders:

This is a featured story on Amazon Q3 revenue announcement, covering insights from the industry leaders:

- Chris Hauca, MD at Avionos

- Harvey Ma, Senior VP of Omni, Consumer & Retail Performance of North America at NielsenIQ

- Tom Caporaso, CEO of Clarus Commerce

- Sean Turner, CTO of Swiftly

- Lisette Huyskamp, CMO Productsup

- Kristina Goldberg, SVP, Media Services at Adswerve

- Craig Elston, Head of Strategic Services at Iterable

- Mukesh Pitroda, Senior Director at Nerdery

- Kevin Beasley, CIO at VAI

- Jat Sahi, Retail Consulting Industry Lead, Fujitsu UK

- Hugh Fletcher, Global Head of Consultancy and Innovation at Wunderman Thompson Commerce

- Steve Ricketts, UK Head of Ecommerce at MediaCom

Here’s what they had to say.

Amazon Must Navigate Ongoing Supply Chain Issues and Inflation to Continue to Drive Customer Loyalty

Chris Hauca, MD at Avionos

Commerce expert Chris Hauca, managing director at Avionos, which designs and implements digital commerce and marketing solutions for clients like Kellogg’s, JLL and Brunswick, said –

“Online shopping has continued its acceleration with convenient pick-up or delivery tied with quick availability being the winning elements. Customers have seen significant improvements and increased availability of curbside pickup and same-day delivery which are defining expectations going into this holiday shopping season. Considering 62% of consumers trust large retailers such as Amazon to offer flexible delivery options, the eCommerce giant has the manpower and the right technology to keep up with evolving consumer demands. Amazon’s ability to deliver items on time and through lower-cost third-party vendors will boost Amazon’s earnings this quarter. Like every other retailer, Amazon will have to compete with supply chain shortages but already has a built-in buffer due to its cross-country fulfillment center strategy and the sheer scale of its in-houselogistics operation. Consumers will also gravitate towards Amazon when other retailers fail to deliver due to the company’s unmatched consistency.|

Chris continued, “With the holiday season and heightened demand for products in every category right around the corner, Amazon must navigate ongoing supply chain issues and inflation to continue to drive customer loyalty. To retain its dominance as the eCommerce powerhouse, Amazon must keep its robust logistics and delivery networks running at peak operation this holiday season as they now have the majority of their logistics and last-mile delivery in-house. They own their destiny and can offer some of the industry’s most flexible and predictable delivery options to their customers. This advantage should shield them from the possible shortages and shipping delays that smaller organizations will likely experience this holiday season.”

Amazon Should Focus on Omnichannel Retail Strategies

Harvey Ma, SVP at NielsenIQ

(Retail expert) Harvey Ma, Senior VP of Omni, Consumer & Retail Performance of North America at NielsenIQ

“Amazon’s recent announcement to roll out “Local Selling” confirms the need and business opportunity for retailers to meet consumers where they are, particularly as consumer preferences continue to be redirected in an omnichannel environment. Our omnichannel data indicates that currently, 21% of consumers need to look for new retail options given stores they previously shopped in have closed.

40% of consumers are now opting to shop more online because they now have the option to receive and pick up deliveries with new work-from-home allowances. These percentages continue to rise signaling that this “trend” is in fact, the new normal.

And it’s not just about location – the concept of “immediacy” and consumer fulfillment continues to be a hot omnichannel topic.

Not necessarily confined to speed, but the freedom for consumers to choose when they want it. In other words, consumers may not necessarily need it now, they want the flexibility to choose both where and when they would like to have their items delivered or picked up. Retailers that are able to seamlessly deliver upon both of those experiences will more than likely see success across sales and share metrics.”

Nothing to Worry As Yet: Amazon Prime’s Fast Shipping Promise Continues to Attract Loyal Customers

Tom Caporaso, CEO Clarus Commerce

Loyalty/Retail Expert Tom Caporaso said, “With the back-to-school rush mixed with an early warning to begin holiday shopping, Amazon saw a boost in purchasing, especially thanks to Amazon Prime’s fast shipping promise. Delivery times are becoming significantly longer at many retailers, and Clarus Commerce found that 68% of U.S. shoppers are joining loyalty programs right now for special expedited shipping, meaning Prime enrollment could be climbing higher as consumers tackle their wish lists early.”

Tom added, “Prime isn’t the only loyalty program offering better holiday perks for enrollees. In fact, Walmart+ and Best Buy’s TotalTech are promising members early access to coveted items that will likely run out of inventory soon, like electronics, children’s toys, and other gaming systems. It’s a smart move that we might see from other retailers soon, as 21% of shoppers say exclusive access to member events like special Black Friday hours was a top benefit they were looking for in loyalty programs during the holidays. While Walmart is determined to eventually take over Amazon as the top U.S. retailer, Amazon still provides more perks in its loyalty program that consumers love, including Prime Video, Amazon Music, and Prime Wardrobe. While both brands will be pushing Black Friday events for their members earlier this year, we can also expect both programs to continue pushing special access to win over more enrollees.”

Amazon’s Move to Grocery Space is an Attractive Proposition for Retail and E-commerce Marketplace

Sean Turner, CTO of Swiftly

Grocery expert Sean Turner, CTO of Swiftly, a digital loyalty platform for brick-and-mortar grocers said, “Despite slowing earnings, Amazon is showing momentum in the grocery space. The digital leader is steadily expanding its line of Fresh grocery locations to bolster sales both online and in brick-and-mortar stores, combining technology and convenience to lure customers away from their local retailer — especially as supply chain issues cause prices to rise and consumers spending behavior to change. Executives agree that prices inflated above 5% likely lead to changing consumer buying habits. Retailers need to offer flexible shopping experiences that attract, retain, and satisfy customers as Amazon attempts to do the same.”

Sean added, “Fortunately, grocers have the opportunity to leverage technologies and meet the needs of each individual customer as their spending habits change. As advertisers pull their investments from platforms like Facebook and Snapchat because of Apple’s changes to support consumer privacy, retailers have a unique opportunity to benefit from these changes by bringing together offline and online shopping through customized advertisements and personalized offers that drive value for shoppers while creating new, high-margin revenue for retailers.”

Amazon Should Continue Tapping Into Every Avenue to Engage Customers

Lisette Huyskamp, CMO Productsup

Marketing expert Lisette Huyskamp, CMO at e-commerce data integration company Productsup said, “Amazon may have surpassed Walmart as the largest retailer outside of China in August, however, there are still several evolving factors, including customer preferences and loyalty programs, that put the title of world’s leading digital marketplace up for grabs. Amazon’s success in 2021 thus far can be attributed to its customer-centric approach that prioritizes convenience to edge out global competition like Alibaba.”

Lisette added, “Despite challenges like supply chain restrictions, Amazon is tapping into every avenue to engage customers as we head toward the upcoming holiday season and into 2022. For example, the e-commerce giant recently announced plans to open department-style retail locations, a strategy focused on customer acquisition outside of its traditional digital environment. Amazon also just rolled out plans for “Local Selling”, a tactic designed to help local and regional retailers provide added convenience to customers through quicker delivery and pickup options…

…Ultimately, Amazon’s success is largely due to its ability to appeal to customers wherever they’re at in their shopping journey. Given the growing complexity of connecting products to consumers, if Amazon continues to cut through the chaos and master commerce anarchy by prioritizing the customer experience, we can expect to see it maintain growth while other leaders like Alibaba and Walmart fall behind.”

Amazon Is Fortifying Its Search, CTV and Other Strategies and Capabilities

Kristina Goldberg, SVP, Media Services at Adswerve

E-Commerce expert Kristina Goldberg, SVP, Media Services at Adswerve said, “While the e-commerce demand that started at the beginning of the pandemic has started to let up toward the end 2021, Amazon continues to hold onto its reign as an e-commerce and advertising leader. Despite recent supply chain and labor challenges having caused the retail giant to fall short of Q3 expectations, Amazon still managed to post their fourth consecutive quarter exceeding the $100 billion mark for revenue earnings. To compensate for the slowing demand in online shopping, Amazon is fortifying its search, CTV and other strategies and capabilities to capture consumers’ attention and create personalized ads. The earnings today showcase that Amazon’s focus in providing these enhanced customer experiences is the best approach to earn revenue and consumer loyalty. Amazon’s Prime Video offering continues to contribute to the company’s overall success. As brands experience successful advertising results via CTV platforms and other digital platforms, Amazon is sure to see ongoing growth.

Kristina added, “Despite the major economic disruptions of the past year, we can expect to see Amazon maintain its stronghold in e-commerce and advertising. Despite lower earnings than expected, Amazon will likely lead the way in online shopping in the last quarter of the year and set the company up with a fresh slate for 2022.”

Amazon’s Decision Making Is a Lesson for Other Retailers: Deliver a Positive Customer Experience

Craig Elston, Head of Strategic Services at Iterable

Retail and marketing expert Craig Elston, Head of Strategic Services at Iterable said, “It should come as no surprise that Amazon’s earnings are at the mercy of economic pressures. In Q3, we’ve seen a plateau in consumer demand, challenges in the supply chain, and the rising cost of fulfillment. To mitigate the effects of these forces, Amazon has invested heavily in staff recruitment, increased wages, and deployed powerful (and expensive) retention programs like free college tuition. While these expenditures have impacted Q3 earnings, they will set Amazon up to succeed in Q4 and beyond; 42% of shoppers in the US plan to spend more money on gifts this holiday season compared to 2020. Maintaining a positive customer experience, and managing shopper expectations requires manpower and morale — both of which were bolstered by Amazon’s Q3 spending. Amazon’s decision making is a lesson for other retailers: deliver a positive customer experience in the face of seasonal headwinds, and you can capitalize on an increase in consumer demand.”

Craig added, “Amazon’s roll-out of their new BOPIS service “Local Selling”, allowing local and regional stores to provide in-store pick-up and local delivery, will boost the holiday season shopping experience for their customers. It is likely to hit other big retailers (such as Walmart) most of all. Shoppers will be able to have the online Amazon buying experience with fulfillment coming through what will become a huge footprint of local and regional stores, with the full impact taking effect throughout 2022.”

Q3 is An Abberation: Even The Pandemic Buying Habits Couldn’t Stop Amazon in 2020

Mukesh Pitroda, Senior Director at Nerdery

Retail and Digital expert Mukesh Pitroda, Senior Director at Nerdery said, “It’s no secret — Amazon continues to grow this year. Propelling Amazon forward are the pandemic buying habits that continue to remain constant and consumers’ reliance on Amazon for fast delivery. Amazon’s innovative ventures into grocery, healthcare, and media are also proving to be massive profit centers — beating the skeptics and becoming even bigger focuses for the business.

Mukesh continued, “However, while the earnings prove Amazon is the model for e-commerce strategy and user experience, the company is still vulnerable to the labor shortages and supply chain disruptions plaguing the industry this winter. Despite Amazon’s recent hiring rounds for the holiday season, all eyes are on the brand’s ability to fill labor gaps in fulfillment centers and handle product shortages from third-party suppliers. “It’s clear that while Amazon’s digital strategy can make them seem peerless, they cannot avoid the challenges of today and must pivot its e-commerce and fulfillment abilities to handle the demand.”

Recovery Mode: All Eyes Will Be On How the Retailer Handles the Holiday Season

Kevin Beasley, CIO at VAI

Supply Chain expert Kevin Beasley, CIO at VAI said, “Despite global supply chain challenges hurting Amazon’s Q3 report, the retailer has still managed to emerge with high earnings today, reporting their fourth consecutive quarter reaching above $100 billion in quarterly revenue. Consumers continue to flock to Amazon, drawn by the retailer’s shipping offerings, user experience and vast network of sellers. As the holiday season inches closer, Amazon has remained steady, bringing consumers along for fast and easy delivery services in their retail, grocery, and pharma sectors. At the same time, despite Amazon’s e-commerce and fulfillment capabilities, the company has still shown vulnerability to the labor shortages and supply chain disruptions of the industry. All eyes will be on how the retailer handles the holiday season despite these challenges. Beyond looking at Amazon’s labor strategy, the company also announced that they will be opening up more brick-and-mortar stores. Amazon has proven that consumers are becoming more familiar with tech-enabled and contactless shopping experiences, and the retailer is already ahead of the game. I expect to see other retailers follow suit in their offerings for contactless shopping experiences in connection with both delivery services and curbside pickup. The combination of these advanced e-commerce and in-person offerings alongside the upcoming holiday season leads me to strongly suspect that Amazon will manage a steady beat for the rest of the year.”

Amazon Has Established Itself as a Tour de Force of Retail Ingenuity; Expecting Things to Slide Down a Bit in the Post-pandemic Era

Jat Sahi, Retail Consulting Industry Lead, Fujitsu UK

Yes, in many parts of the world, physical shopping spaces are opening up for the public. It’s getting to pre-COVID-days, and that’s a challenging scenario for Amazon.

Jat Sahi, Retail Consulting Industry Lead, Fujitsu UK, said, “With a new CEO at the helm, today’s results will do little to ease concerns amongst its investors that a downturn is on the horizon. While the retail behemoth has continued to innovate and expand where many others faltered, most recently launching their 4-star physical shop opening in the UK, any assumption that it would still commandeer the same market share with their fingers in so many other pies was always going to be an optimistic one – especially with other pure-plays chasing their tail.

Jat added, “After all, the bulk of Amazon’s profits are made online and that’s a compromising position to be in post-pandemic as consumers make their way back into stores. Add into the mix that supply chain challenges have hindered even the most logistically-diligent eCommerce superpowers, consumer fears around inflation are reducing sales, and the fact that almost all retailers were forced online last year and have therefore become more competitive with Amazon, and their bottom line was always going to take a beating. With all that eating away at Amazon’s profits, there will be a question mark over whether now was the time for Amazon to be channeling so much cash flow into offerings that were never going to ease the pressures it was facing already and, as it turns out, have only added to them.”

Jat continued, “Then there’s the sticking point of hiring and retaining staff. While it has thrown money at the problem, fulfillment and customer experience will still suffer without the millions of staff needed to keep both running smoothly. Amazon has established itself as a tour de force of retail ingenuity over lockdown but, as the peak shopping season fast approaches, this could well be its greatest challenge yet.”

Amazon’s Ability (or Failure) to Live up to the Legacy is Its Biggest Challenge

Hugh Fletcher of Wunderman Thompson Commerce

Hugh Fletcher, Global Head of Consultancy and Innovation at Wunderman Thompson Commerce, said, “In the face of a slight slowing in the online shopping boom and supply chain bottlenecks, Amazon’s Q3 earnings were expectedly down. But with many investors and analysts coming to expect revenue growth from the retail behemoth, it will be the slowdown in operating profits that will inevitably draw the most attention this time around. Having not only withstood but cashed in on the pandemic last year – with almost half (42%) of all spend globally going to digital marketplaces – Amazon seemed impervious to the challenges impacting other businesses the world over. Now, however, between its surge in new customers, rise in orders and the supply chain flux impacting delivery times for everyone, today might finally have revealed a small chink in Amazon’s armour: fulfilment.”

“Despite Andy Jassy’s best efforts, there is only so much Amazon can do to keep up with the exploding consumer demand it established over lockdown. While it’s been spending aggressively on staff hires and increasing its fulfillment capacity hand over fist, there’s no getting away from the fact that now is a tricky time to hire and retain staff for anyone – eCommerce superpower or not – and Black Friday and Christmas will be the true test of its ability to provide the same world-renowned customer service during retail’s peak period. What’s more, What’s more, with three-quarters (73%) of shoppers claiming eCommerce will be more important to them this year than last year, Amazon will need to keep its digital house in order in time for Black Friday and the inevitable pre-Christmas rush.

“Prior to today’s results, investors will have been chomping at the bit to learn whether or not it was prepared to deliver presents in time for Christmas. However, with a huge spike in demand forthcoming (half of the consumers (52%) in the UK use Amazon for inspiration alone), it won’t be a lack of sales that will impact Amazon in the coming months and years, nor a lack of customer loyalty. Instead, it will be its ability to live up to the legacy it has created for itself now that the world is watching.”

Can Amazon Attract and Retain Customers and Make them Spend More Across Categories?

Steve Ricketts, UK Head of E-commerce at MediaCom

Steve Ricketts, UK Head of E-commerce at MediaCom said, “As the pandemic e-commerce boom begins to slow, the challenge Amazon now faces is ensuring that customers are shopping more frequently and spending more across categories, from groceries to media and everything in between. Amazon has already increased investment into customer engagement opportunities, and in the UK we expect to see it increase both branded content and opportunities for brands to establish stores on its platform to continue to foster long-term, loyal connections with their Amazon customer base.”

Steve continued, “Amazon has also grown its streaming content opportunities as it competes with the likes of Netflix, Disney+ and NOW with the launch of IMDB TV. In the UK, this unlocks another medium for brands to create meaningful relationships with their Amazon customer base – and we can expect to see the interactivity of these advertising opportunities develop further, making every touchpoint shoppable. In addition to this, offering Amazon Marketing Cloud whenever Amazon DSP is available allows brands and agencies to further understand the relationships across their media mix providing holistic analysis for customer journeys.”

Steve added, “Amazon is already the third-largest ad platform, behind Facebook and Google, and through these innovations, it is finding new ways to leverage the incredible wealth of customer data gleaned from billions of online transactions that it can use to advertise to consumers with a great level of reach and accuracy. While it’s unlikely that Amazon will overtake Google or Facebook in terms of advertising reach, we can expect the gap to continue to narrow as it continues to invest into brand content and customer engagement experiences. The key for Amazon is to continue to differentiate its ad offering to truly begin to make waves as a major player in the market.”

Comments are closed.