Strategy Analytics: Google’s Share of Global Digital Media Revenues Declined By 2.7% in Q2

Google hit by pandemic-related cuts in ad spend, but Alibaba and Facebook continued to grow

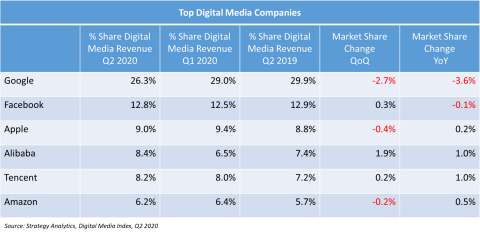

While it is still the world’s largest digital media company by some distance, Google’s digital media revenues fell by 7.0% in Q2 2020 to $38.3B, causing its market share to fall from 29.0% in Q1 2020 to 26.3% in Q2, its lowest share of the global digital media market in the past six years. According to the TV and Media Strategies report, Digital Media Global Competition Review Q2 2020, the major factor was the decline in travel and leisure advertising, in which Google is particularly strong, as a result of behavioral changes brought about by the COVID-19 pandemic. Facebook remained the world’s number two player, with a 12.8% share in Q2, while Apple remained in third place, in spite of a decline in market share to 9.0%. Alibaba, the world’s fourth largest digital media company, was helped by a resurgent Chinese economy and saw its share rise to 8.4% in Q2.

Google’s Share of Global Digital Media Revenues Declined By 2.7% QoQ in Q2 2020 Hitting a Six Year Low

Recommended AI News: ElectrifAi Announces Availability of New Machine Learning Models on Google Cloud Marketplace

The report also found that overall global digital media revenues saw modest quarterly growth of 2.8% in Q2 2020, as the global economy slowly began to recover from the initial impact of the COVID-19 pandemic, and Q2 revenues of $145.7B were also nearly 12% higher than a year earlier. The strongest digital media sector was online games, where Q2 revenues increased by 12.9% over Q1. Digital music revenues fell by 11.4% as time spent listening to streaming music declined in Q2. Online video revenues rose by 2.8% and digital advertising revenues were more or less flat.

Recommended AI News: Alliance Health Invests in ZeOmega’s Powerful Artificial-Intelligence Solution: CareIntel

“The digital media industry has been affected by the pandemic in different ways, depending on segment and geography,” says Michael Goodman, Director, TV & Media Strategies and the report’s author. “China’s recovery in Q2 is an indication that western firms like Google should hope for a similar bounce during the rest of 2020, but there is clearly still a great deal of uncertainty. Firms focusing on entertainment sectors such as video and games have tended to demonstrate superior revenue growth more recently and there is good reason to expect this trend to continue through the rest of the year.”

Recommended AI News: Arbe Announces Availability of the First 2K High Resolution Imaging Radar Development Platform