OKEx’s BTC Perpetual Swap Funding Rates Among the Most Competitive in the Industry

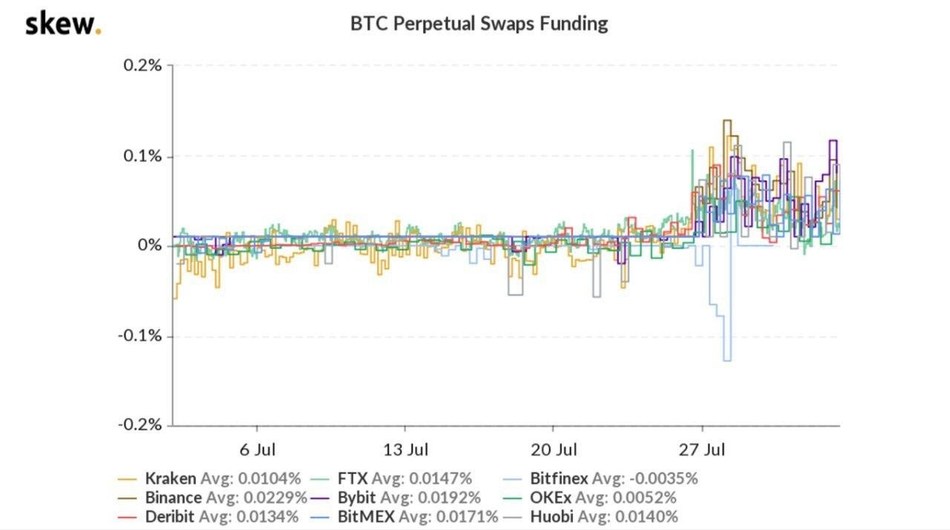

OKEx, a world-leading cryptocurrency spot and derivatives exchange, is providing Bitcoin futures traders with more reasons to trade on its platform in the form of competitive funding rates on its popular BTC perpetual swap market. According to data from skew, of the nine major cryptocurrency derivatives exchanges, OKEx offers the second-lowest swaps funding rates in July — at an average of 0.0052%.

Low funding rates allow traders to realize significant savings when taking out a position on OKEx compared to competing exchanges. This competitive rate is partially due to the exchange’s low-fee policy but also because OKEx does not skew its funding rate in favor of market makers. This is especially appealing to traders during a bull market, as they can maximize their profits by moving their long positions to OKEx.

Recommended AI News: Involta Achieves Advanced Consulting Partner Status In The AWS Partner Network

OKEx CEO Jay Hao commented:

“Thanks to the way we construct our swap funding rates, we have been able to offer retail traders a much cheaper rate over the last month of the bull market. Opening the same long position on another exchange would have resulted in much higher funding fees. Most retail positions are still long at the moment, signaling bullish momentum for Bitcoin. And since we don’t favor market makers, OKEx even saw some negative funding rates during the week of July 20 to July 27.”

Recommended AI News: Zerto Selects BillingPlatform to Power Growth Initiatives and Streamline CX

Reduced funding rates can be a major pull for retail traders looking to enhance their profit strategies and, beyond low fees, OKEx provides a secure and robust platform with a comprehensive risk-management system. During Sunday’s wipeout, for example, when Bitcoin dropped $1,500 from $12,000 within a matter of minutes, OKEx’s risk-management measures — including a proprietary liquidation engine, position limits and a tiered margin system — meant that, unlike other exchanges, the unexpected volatility led to zero clawbacks and zero ADL.

“With swaps funding rates substantially cheaper than on other competing exchanges, and a robust environment for trading in volatile markets, we aim to provide traders with the safest and most appealing platform for trading perpetual swaps,” Mr. Hao added.

Recommended AI News: Michael Brozino Joins Maverick Medical AI as Co-Founder and Chief Commercial Officer

Comments are closed, but trackbacks and pingbacks are open.