Goldman Sachs Leads Top Ten Global M&A Financial Advisers in ICT Sector

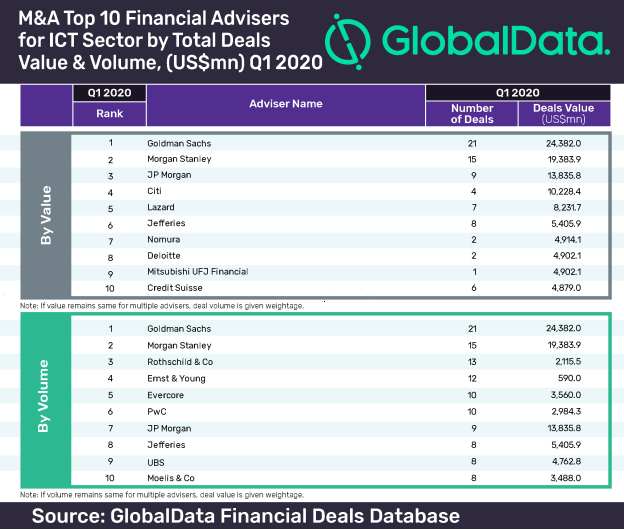

Goldman Sachs held the top rank in the latest global mergers and acquisitions (M&A) league table of the top ten financial advisers for the information and communication technology (ICT) sector by value and volume in the first quarter of 2020, according to GlobalData, a leading data analytics company.

The US-based investment bank took the top spot with a deal value of US$24.38bn for advising on 21 deals.

GlobalData, which tracks all M&A, private equity/venture capital and asset transaction activity around the world, confirmed that Morgan Stanley finished at second position with 15 deals worth US$19.38bn and JP Morgan at third position with nine deals worth US$13.83bn.

Recommended AI News: Big Data, Better Healthcare

Ravi Tokala, Financial Deals Analyst at GlobalData, says: “The absence of megadeals (>US$10bn) and that there are less than 25 deals crossing US$1bn value in Q1 2020, led to a drop in overall deal value in the ICT sector, which could be attributed to market turmoil caused by COVID-19. With respect to value, only Goldman Sachs was able to cross the US$20bn mark, topping the financial adviser category.

Recommended AI News: Big Data, Better Healthcare

“M&A activities in the sector started on a slow note in 2020, with Q1 witnessing a drop in deal activity, as compared with the same quarter last year. Almost all of the top ten advisers by volume advised less than 15 deals – except Goldman Sachs and Morgan Stanley, which managed to work on 21 and 15 deals, respectively.”

Global ICT deals market in 2020

On the back of the COVID-19 outbreak, deal activity remained sluggish and the ICT sector witnessed a decline of 35.56% in deal value from US$173bn in Q1 2019 to US$111.5bn in Q1 2020. Deal volume decreased by 11.52% from 4,914 to 4,348.

Goldman Sachs also led the recently released global league table of top 20 M&A financial advisers by GlobalData. In terms of deal volume, Goldman Sachs and Morgan Stanley also stood at the first and second positions. Rothschild & Co took the third spot with 13 deals worth US$2.11bn, followed by Ernst & Young with 12 deals worth US$590m.

Recommended AI News: SAP Makes Support Experience Even Smarter With Machine Learning and AI Enhancements

Comments are closed, but trackbacks and pingbacks are open.