Convenience, Preparation and the Outdoors: A Tale of Three Different Months of March for Consumer Packaged Goods

- Outdoor Products Are a Growing Priority in March 2021, A Sharp Change From Pandemic Preparation One Year Earlier, and a Departure From Convenience Buying In March 2019

NCSolutions (NCS), the leading company for improving advertising effectiveness for the consumer packaged goods (CPG) ecosystem, has completed analysis of three-years of shopper data for the months of March, revealing three distinct themes for 2019, 2020 and 2021: convenience, preparation, and the outdoors, respectively.

Recommended AI News: FedEx Office, Vericast Unveil Branded Product Marketplace

The contents of the March 2021 American grocery cart are changing towards outdoor celebrations, a sharp divergence from baskets in March 2020, which were centered on pandemic preparation, and those in March 2019, which contained more convenience products.

The pandemic is still driving atypical purchase behavior in March 2021, with first aid items (2,782%) being the top-growing category. This category includes masks, which weren’t a widely purchased item pre-pandemic. Consumer purchase data reveal Americans are acting on built-up desire for in-person, outdoor gatherings as spending on outdoor and party-related items surged during the month compared to March 2020. Three of the top-growing categories for March 2021 are lawn (137%), garden and grilling (87%) and outdoor weather supplies (103%).

The pandemic is still driving atypical purchase behavior in March 2021, with first aid items (2,782%) being the top-growing category. This category includes masks, which weren’t a widely purchased item pre-pandemic. Consumer purchase data reveal Americans are acting on built-up desire for in-person, outdoor gatherings as spending on outdoor and party-related items surged during the month compared to March 2020. Three of the top-growing categories for March 2021 are lawn (137%), garden and grilling (87%) and outdoor weather supplies (103%).

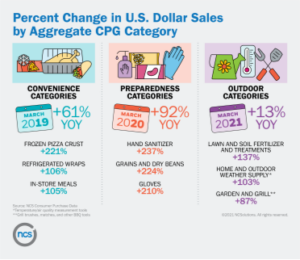

By comparison, in March 2019, convenience items were the priority and the top-growth categories, year-over-year, included frozen pizza crust (221%), refrigerated wraps (106%) and in-store meals (105%). One year later, March 2020 was marked by pandemic preparation, with six of the top 10 growing categories surging at higher rates than most items in the March 2019 basket: hand sanitizer (237%), gloves (210%), antiseptics and disinfectants (181%), bleach (176%) and fruit and vegetable wash (158%).

U.S. spending on outdoor categories at grocery retail rose 13% in March 2021 (compared one year prior). Spending on preparedness products in March 2020 was up 92%. Spending on convenience-related CPG categories in March 2019 was up 61% year-over-year.

NCSolutions-defined outdoor categories encompass products such as garden items, barbeque accessories and suntan products. Convenience-related CPG categories include products such as in-store meals, frozen foods and fresh pasta and sauce. Pandemic preparedness items are inclusive of categories such as dry grains and beans, shelf-stable soup and toilet paper.

“Movement was a predominant feature of American, pre-pandemic life in March 2019. Consumers leaned heavily on convenience items to sustain their life-on-the-go,” said Linda Dupree, chief executive officer, NCSolutions. “But grocery carts are indicative of what is important. The new data analysis proves what we’ve suspected from our social media feeds: after more than a year of social distancing, Americans are showing signs of returning to that life but are doing so with a focus on being outside.”

“Movement was a predominant feature of American, pre-pandemic life in March 2019. Consumers leaned heavily on convenience items to sustain their life-on-the-go,” said Linda Dupree, chief executive officer, NCSolutions. “But grocery carts are indicative of what is important. The new data analysis proves what we’ve suspected from our social media feeds: after more than a year of social distancing, Americans are showing signs of returning to that life but are doing so with a focus on being outside.”

“Higher spending on outdoor and celebratory items is a strong sign that momentum is building for a return to a social lifestyle, beginning with at-home outdoor celebrations,” Dupree said. “CPG spending continues to remain high compared to March 2019, and as summer draws closer, there will be a growing opportunity for advertisers to be a part of a re-entry into social engagements for Americans. CPG brands might consider connecting with their buyers through advertising creative and messaging that reminds them all how favorite foods make a social occasion even more memorable.”

Recommended AI News: Harness Empowers Developers with Cloud Agnostic End-to-End Software Delivery Platform

OUTSIDE IS THE PLACE TO BE

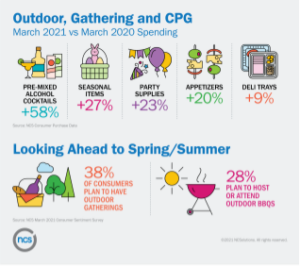

As we enter the warmer months of the spring and head into the summer, NCSolutions expects the focus on outside gatherings to accelerate even further: 38% of consumers say they plan to have outdoor gatherings, while 28% say they plan to host or attend outdoor BBQs, according to the NCSolutions March 2021 Consumer Sentiment Survey, a nationally representative consumer survey with 2,017 respondents, ages 18 or older.

While consumers have continued to mark major milestones, from birthdays to retirements and anniversaries throughout the pandemic, these celebrations have looked markedly different with social distancing in place. Since the onset of the pandemic, 56% of Americans reported celebrating major life events at home with household members and only 21% celebrated at home with loved ones outside of their household, according to the survey.

As further evidence, spending on garden and grilling consumer packaged goods, party supplies, and pre-mixed alcohol cocktails all increased in the month of March. Shoppers also added seasonal items, appetizers and deli trays to their grocery baskets – signs they’re ready to hold more in-person events.

“Beyond outdoor and celebratory supplies, other spending categories will continue to benefit from this pent-up socialization demand,” said Dupree. “As more people are vaccinated and meet face-to-face, the desire to look their best will be strong. Sales of personal care categories like hair care accessories, fragrances and suntan products have already eclipsed March 2020 levels, and I expect sales of other personal care and beauty items to be on an upward trajectory from now through at least the summer and perhaps beyond.”

In its new analysis, NCS reports its total household spending on groceries remains elevated: March 2021 spending is 10% higher than March 2019 and 16% below the pandemic spending levels of 2020.

Comments are closed.