Artificial Intelligence: Its Potential Economic Impacts & Opportunities

By: Luke Ervin, CIMA, Financial Advisor, UBS

Artificial Intelligence, commonly known as AI, is considered perhaps to be the most profound innovation and one of the largest investment opportunities in human history. Software may become ubiquitous. Data assets will likely emerge as the competitive differentiators for AI adopters.

But even with all the hype, it is important to understand that AI, in and of itself, is not a terribly recent phenomenon. Computers were beating some of the world’s best chess players in the 1980s, IBM’s Watson won Jeopardy in 2011; Google’s search, Apple’s Siri, Amazon’s Alexa – all these are AI and much of this has become part of our daily lives increasingly in recent years. But in the last five years or so, something seemingly subtle, but wildly transformative happened – these computers have mastered our language. Not just the English language (and others), but the personal, emotional, intelligent nuances of any language instead of the robotic output one might expect from a machine.

Also Read: Why Responsible AI Principles Matter for Advertisers

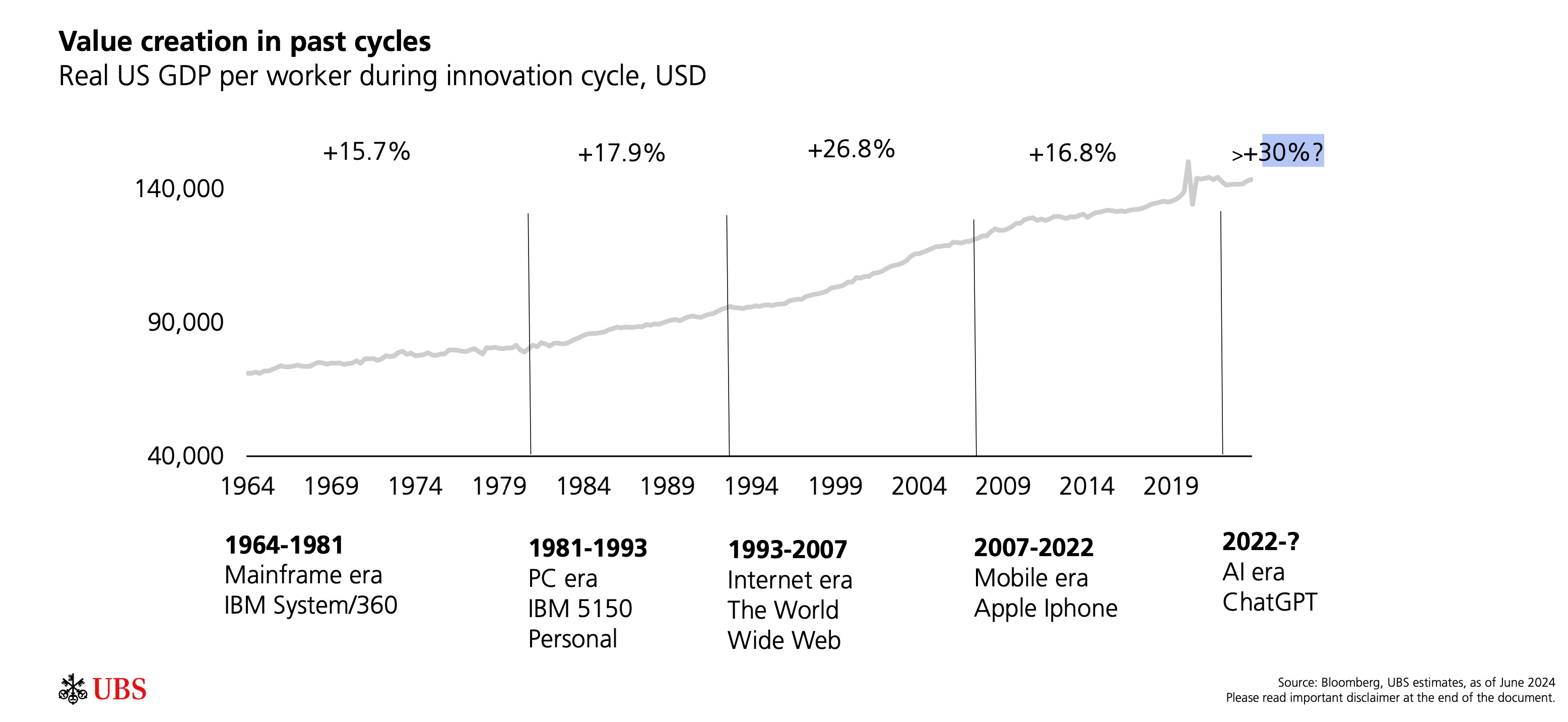

As with any transformative technology there are plenty of concerns. What if LAMs (large action models) get into the hands of bad actors? How can we tell what is “real” and what is not? Will we and future generations rely on the technology so much that we, as a species, become less intelligent? These are all good concerns, ones I have as well and, unfortunately, don’t have any answers for. But the one that I may be able to lend some perspective on is the economic impact – Will AI take my job? And the answer there is – very possibly it could. As with every major transformative technology, like machines in the Industrial Revolution and the Internet in the 1990s, the landscape of the workforce may change. The good news, however, is that history has shown workers have adapted well in those times to change with the times.

I don’t see this time being any different. Some roles might be more vulnerable than others – one example could be Customer Service. Those positions have largely been outsourced to multiple countries over the past couple decades and more recently, some have already been replaced with AI. That doesn’t mean that if you are in Customer Service you will not be able to have a job anymore, but it does mean that you should be ready to work very closely alongside AI if you wish to stay in Customer Service.

The less appreciated risk I see is that, as of now, the majority of the AI universe is essentially in the hands of very few companies. And recent observations from UBS1 agree that monolithic players will emerge along the AI value chain, and over time, the AI market will be dominated by an oligopoly of vertically integrated “AI foundries.” These companies are trillion-dollar plus companies, and have all the data, technology, talent, and money to keep a stranglehold on AI’s future. When this happens there are Antitrust concerns, which means that they may be forced to break up or divest of business units, which might be good for competition, but it is TBD if this will help proliferation, help drive efficiencies, bring down costs, make it safer, etc. Too many unknowns, at the moment.

The economic benefits of AI, however, are obvious. Productivity should go through the roof. When workers are more productive with their time, there are massive cost savings, which in turn leads to lower inflation.

Also Read: Using Generative AI for Decision Intelligence With Pyramid Analytics

The question we regularly receive is: “Is this a bubble, from an investment perspective?” In comparison to the late 90’s, early 2000’s “dot com” run-up and subsequent crash of online stocks, is it likely to be the same? Sure, there are some similarities – stock prices of the cohort have dramatically gone higher in a short period of time, mainstream media is beating us over the head with the topic, hyperbolic promises, and so on. But this certainly is not a bubble in the truest sense of the word, as it relates to valuing stock prices. The reason lies in the main way to evaluate a stock price, which is the Price-to-Earnings (P/E) Ratio, where you simply divide a company’s stock price by the earnings per share. If the P is going up but the E is not, it may be a bubble; but that is not the case with the stocks of the AI cohort, so it is hard to make a case that this is a bubble. In the dot-com era, the “P” was going higher, but there was low, to no, “E”, in the internet stock cohort, which is why with the benefit of hindsight, it was an obvious bubble. With that said, the buzz can fade and the growth can decelerate or even worse, drop considerably, but this is not the same as Pets.com in 2000 or tulips in the 1630’s.

The artificial intelligence market potential is vast, and it is predicted that AI value creation could be $1.16 trillion by 20271. For many, this might be the time to size, and seize, the investment opportunity. For those interested in investing in the space using stocks, there are a variety of ways to do so. Let’s look at several layers in the AI value chain that can help in assessing investment opportunities:

The enabling layer – The first layer includes the companies that provide the backbone for AI development, i.e., chip and infrastructure stocks – these are the semiconductor companies that are providing the computing power for AI, and companies involved in power supply. Lastly, part of the enabling layer is what I would call AI adjacent stocks – they might not be the A nor the I in AI, but without it, there would be no AI. Here, think about the data centers that are storing acres of computer racks needed for the computing power, the companies providing cooling services to cool these computers, and the companies providing the massive amounts of energy to these data centers.

The intelligence layer – the companies turning the computing and energy resources from the enabling layer into intelligence. This includes those developing large language models, as well as companies that own datasets that can be turned into intelligence. These may also be known as the “hyperscalers” – I think of these companies as the ones generating and storing data in the “cloud.” Think about smartphone companies that many entrust with much of their personal lives; car GPS companies that know where people go; Internet search companies that know what you search for online, or social media companies that know whom and what you interact with. This data is arguably one of the world’s most valuable assets and is critical for AI, heck, it is the I in AI.

The application layer – those companies which embed the tools from the intelligence layer into specific use cases. For now, we believe the most promising applications include copilots, coding assistants, digital advertising, call centers, healthcare R&D, cybersecurity, and fintech.

Speaking of data centers and energy above, this is another place where there could be potentially significant investment opportunity as it relates to AI. The extra amount of energy needed for AI is staggering. The average AI-generated response to the same question you pose on a traditional search engine takes ten times more power. With the proliferation of AI and everyday adoption of the technology increasing, where are we going to get the energy needed? AI queries suck a massive amount from the “Grid,” so old-fashioned utility stocks should benefit; nuclear is a viable low-carbon alternative, but certainly renewables (solar, wind, etc.) should be the most cost-effective way to power these facilities, which make them interesting AI adjacent investments.

A couple more observations:

The AI market potential is vast, so be sure to be sufficiently invested in all the layers. Many investors have built at least some exposure to AI over recent months. Yet the sheer pace of growth in the industry means that many investors may remain under-allocated overall.

Don’t cut the winners too soon. The AI rush so far has been highly beneficial for the largest tech firms, many of which are expected to continue to stay at the lead in the race.

It’s not only about the US. For instance, China looks to be developing an AI ecosystem distinct from much of the rest of the world, which could potentially lead to significant monetization potential.

Stay informed. And if you don’t have the time to read everything you would like to, work with an experienced and trusted financial advisor to keep you abreast of AI as it changes and grows.

Sources:

- UBS Chief Investment Office GWM Investment Research 10 June 2024

- Chart: Bloomberg, as estimated by UBS Chief Investment Office/Features/AI 2024

The information contained in this article is not a solicitation to purchase or sell investments. Any information presented is general in nature and not intended to provide individually tailored investment advice. The strategies and/or investments referenced may not be suitable for all investors as the appropriateness of a particular investment or strategy will depend on an investor’s individual circumstances and objectives.

The information contained in this article is not a solicitation to purchase or sell investments. Any information presented is general in nature and not intended to provide individually tailored investment advice. The strategies and/or investments referenced may not be suitable for all investors as the appropriateness of a particular investment or strategy will depend on an investor’s individual circumstances and objectives.

Investing involves risks and there is always the potential of losing money when you invest. The views expressed herein are those of the author and may not necessarily reflect the views of UBS Financial Services Inc. Neither UBS Financial Services Inc. nor its employees (including its Financial Advisors) provide tax or legal advice. You should consult with your legal counsel and/or your accountant or tax professional regarding the legal or tax implications of a particular suggestion, strategy or investment, including any estate planning strategies, before you invest or implement.

As a firm providing wealth management services to clients, UBS Financial Services Inc. offers investment advisory services in its capacity as an SEC-registered investment adviser and brokerage services in its capacity as an SEC-registered broker-dealer. Investment advisory services and brokerage services are separate and distinct, differ in material ways and are governed by different laws and separate arrangements. It is important that you understand the ways in which we conduct business, and that you carefully read the agreements and disclosures that we provide to you about the products or services we offer.

[To share your insights with us as part of editorial or sponsored content, please write to psen@itechseries.com]

More From Our AI Inspired Series by AiThority.com: Featuring Bradley Jenkins, Intel’s EMEA lead for AI PC & ISV strategies

Comments are closed.