The Future of Fintech at CES 2020 with AI, Crypto, Threat Intelligence and So Much More…

Recent advancements in financial technologies (fintech ecosystem) have created many faces of growth for businesses. A combined force of technology, human intelligence, governance, and politics underpin the rate of success for fintech players and their products. According to Accenture’s latest report on Fintech meta-trends, global cashless payments, digital currencies, and AI would be the biggest disruptive forces by 2024. Physical money or “cash transactions” would be completely replaced by traceable, programmatically-secured file transfers (run on Crypto, Blockchain and similar encrypted platforms). At CES 2020, a global technology event, fintech leaders and industry analysts are huddling together to discuss and pinpoint to the trends and opportunities ushering the new decade.

In this article, we reveal the nature of discussions at CES 2020 that are likely to decide the future of fintech and related technologies.

Automation is the Future of Digital Banking

It’s important to link the rise of Banking-as-a-Service (BaaS), Mobile Growth and AI applications to accurately chart the future of fintech.

Since 2010, fintech ventures have earned over $100 billion as investments. This alone shows how valuable this fintech startup zone truly is.

The global trend of embracing Digital Transformation has influenced the banking systems as well. According to Business Insider’s report titled “The Evolution of the US Neobank Market”, the rise of digital banks (also called as neo-banks) is pegged on three developments–

- Economic regulations

- Shifting consumer attitudes with mobile and physical banking experiences, and

- The activity of incumbent banks

The report has found out that the digital banking trends in the US and the European Union are shifting gears faster than anywhere else. The BaaS and fintech players catering to these two regions could set the cadence for the marketplaces in the lagging zones.

Banking systems are turning to neo-financial practices and policies to stay attuned to consumer demands. Digital Banking, with AI and Robotic Process Automation (RPA) at its core, reflects a changing paradigm in the way banks and financial institutions operate today. The digital journeys started with simple net banking and mobile app payments. Today, digital banking practices have branched into numerous applications, both at the front and the back-end.

As banking systems embrace automation we would see a large volume of transactions occurring through non-banking systems.

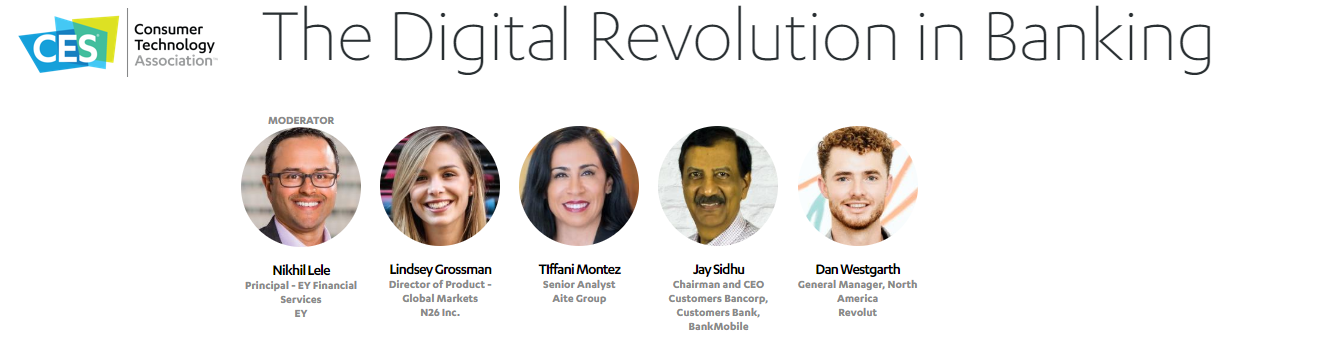

At CES 2020, Nikhil Lele, Principal – EY Financial Services (EY), will sit down with Lindsey Grossman (Director of Product – Global Markets at N26 Inc.), Jay Sidhu (Chairman and CEO at BankMobile), and Dan Westgarth (GM-North America) of Revolut.

Session: The Digital Revolution in Banking, Jan 7

The Crypto Effect: What Libra has Done to Fintech Adoption

In 2019, Facebook started a unique fintech journey with its Libra currency. Libra is an international, “digitally native, reserve-backed Cryptocurrency” that is built on Blockchain technology. As such, communities in developing countries, like India, will be able to send, receive, spend, and secure their money, enabling a more inclusive global financial system.

It was speculated that the new crypto platform will force Facebook to reveal its plan for future management of user information and data privacy. Putting enhanced focus on data governance has put fintech on an aggressive territory. Major global payment systems and mobile apps are integrating their services to Facebook’s Libra. These include Google, Uber, and others who want digital natives to bank with them.

In the first roundup on the future of crypto and Libra’s role in the ecosystem, Michael Casey (CoinDesk) and Dante Disparte (Libra Foundation) reveal the tectonic shifts in the industry.

Amy James (CEO Alexandria Labs), Andrew B. Morris (Founder and CEO- The Fintech Agenda LLC), Robin Raskin (Founder of Living in Digital Times (LIDT)), and Akin Sawyerr, Strategy + Governance Lead at Decred, would join Casey and Disparte.

Session: The Libra Effect, 7 Jan

Buh, Buh, Buhhhhhhh… Voice Assistants and Botssssss!!!!

Bot machines could be greeting you at the nearest ATM. Or, they could be helping you apply to fill your first Home or Education Loan form. And, in that entire value chain of BaaS, Voice-based conversations would be the most engaging platforms.

It was speculated that by 2020, 50% of the banks could cater to any online customer query through Voice search. We’re still far from achieving these numbers. However, Conversational AI in Banking, like it has done to retail and mobile commerce, could flip the trends on its head in the next 3-4 years. Large-sized banks with global operations are already ahead with their testing and experiments using AI-based Voice recognition. These come with an added layer of biometric-based iris matching, fingerprint recognition, and other unique identification technologies. The combination of Conversational AI and Voice could definitely fasten the adoption of digital banking, security and ID matching for fintech-specific Cloud Call centers and customer service companies.

New emerging technologies such as AR VR Wearable, Tablets, and Connected Devices would also enhance digital banking and fintech adoption.

Moderator Robin Raskin of LIDT would be taking the central podium to discuss how AI and machines would power near-human banking and commerce experiences.

Jeremy Balkin (Head of Innovation at HSBC), Will Graylin (CEO- OV Loop, Inc.), Jim Kearney (Principal- Point B), Danny Tomsett (CEO at UneeQ) would join Robin at the event.

Session: Conversational Fintech: The Bots Get More Human

Fintech’s Intersection with Governance, ID Trust, Security, and Cyber Threat

In addition to the marquee discussions on the future of fintech, we are expecting leaders to divulge their ideas on the contemporary hurdles and challenges in the ecosystem. These include trust issues related to credit card data, customer identity authentication, security access, and government regulations. Companies like AWS, Salesforce, SAP, Oracle, and other Cloud providers are diversifying their Commerce suites to benefit unique banking systems meet their digitization goals.

During the event, we will hear stories and case studies from leading Digital Transformation enablers. These include –

- Travis Jarae, CEO – One World Identity

- Phil Chen, Decentralized Chief Officer – HTC

- Joe Cutler, Partner- Perkins Coie LLP

- Bimal Gandhi, CEO- Uniken, Inc

- Rob Wisniewski, Chief Technology Officer- CLEAR

- Steven Becker, President, and COO- MakerDAO

- Rick Bleszynski, CEO- Zocial

- Pooja Shah, Co-Lead, Filecoin – Protocol Labs

We know that nothing can separate AI and NLP from ongoing Digital Transformations. To add to the recipe, we expect leaders to discuss the role of 5G, Cyber threat intelligence, Internet of Things (IoT), Connected Banking, and Personalization in making future of Fintech realistic and universal to the daily life.

(To participate in our featured stories, please write to us at news@martechseries.com)

Comments are closed, but trackbacks and pingbacks are open.