iTrustCapital Clients Ditch Paper ETFS for Gold Bullion in Retirement Accounts

iTrustCapital, an investment platform for alternative assets in retirement accounts, reports that 43% of new customers utilizing its Gold investment platform plan to transfer assets out of Gold ETFs.

“Since we launched Gold on our platform, most of the clients I speak to are moving funds from gold ETFs to fund their accounts. A common theme is a complete loss of trust in government and Wall Street.” –Blake Skadron, Chief Operating Officer of iTrustCapital

Recommended AI News: SecurityMetrics Summit Brings New Ideas and Innovation to Data Security and Compliance

National governments worldwide continue to print seemingly endless amounts of money and rack up the national debt. Many people fear their life savings will evaporate from inflation. The cold reality is that the recent shutdown has exponentially increased the past sins of fiscal and monetary policy, including budget deficits and quantitative easing.

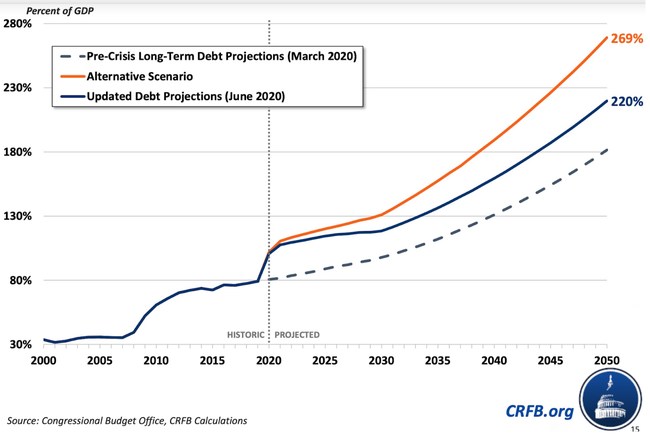

After pumping nearly $9 trillion into the system since March 2020, America’s total debt could exceed 180% of GDP by 2040, according to Projections from the nonpartisan Committee for a Responsible Federal Budget.

“Debt levels are getting to the point where governments will increasingly be incented to devalue their currencies to service that debt.” Tim Shaler, Chief Economist iTrustCapital

Recommended AI News: Crypto.com Appoints Steven Kalifowitz as Chief Marketing Officer

Americans seek ways to protect their wealth in a system stressing itself to the limits. Even though investors have billions of capital in Gold ETFs like GLD, many others distrust these traditional financial offerings. They want the added security of knowing the Gold exists and tied to an account in their name.

iTrustCapital clients are indeed favoring the move to physical Gold lately, placing these trades through iTrust’s interface. Those trades are executed through precious metals leader Kitco and securely stored at the Royal Canadian Mint. The assets are 100% backed with physical metals and deliverable upon request through iTrust’s service.

iTrustCapital’s user interface makes it easy to transfer assets from an existing IRA or 401K. Once on the platform, clients can buy and sell physical Gold in an IRA for just $50 over the spot price.

Recommended AI News: BlackBerry Releases Free Reverse Engineering Tool to Help Fight Cybersecurity Attacks

Comments are closed, but trackbacks and pingbacks are open.