Tax Compliance Costs 67% Higher for Small Businesses

Small Business Owners Spend More Than $1,000; 20 Hours Preparing Federal Taxes

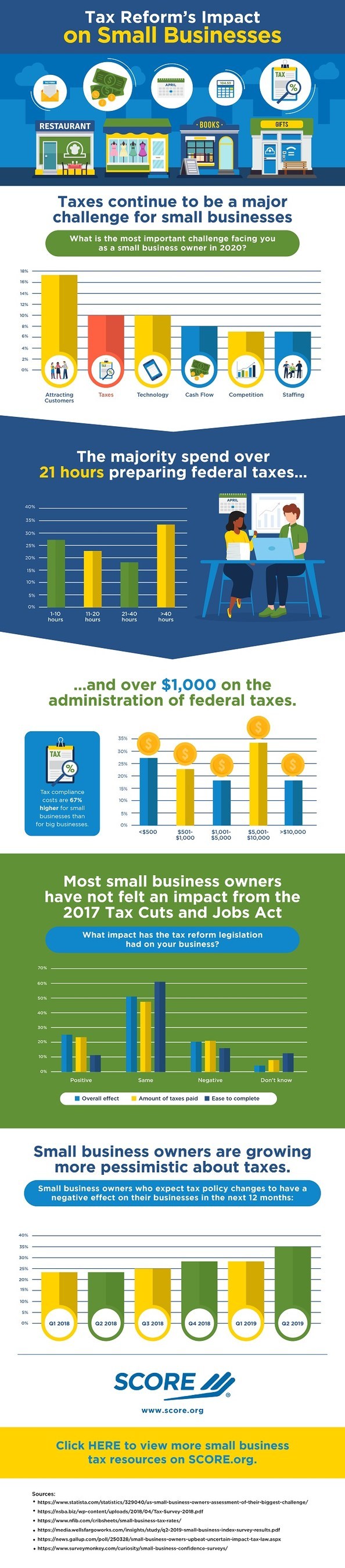

Small business owners are growing more pessimistic about taxes, and report little impact from the 2017 Tax Cuts and Jobs Act, according to data gathered by SCORE, mentors to America’s smallbusinesses. Data shows that most smallbusiness owners spend more than $1,000–and more than 20 hours–preparing their federal taxes.

Recommended AI News: Mark Zuckerberg vs Jack Dorsey – A War About Freedom, Politics, and Cryptocurrency

Small business owners are feeling more pessimistic about taxes:

- 35% of small business owners surveyed in Q2 2019 expect tax policy changes to have a negative impact, up 12% from Q2 2018.

Small business owners report little impact from the 2017 Tax Cuts and Jobs Act:

- 51% of small business owners said the tax reform legislation had no overall effect on their business.

- 25% said the tax reform legislation had an overall positive effect.

- 20% said the tax reform legislation had an overall negative effect, and 4% reported that they did not know the impact of the legislation on their business.

Most small business owners spend more than 20 hours preparing federal taxes:

- 34% of small business owners spend more than 40 hours preparing federal taxes.

- 18% spend 21-40 hours.

- 22% spend 11-20 hours.

- 26% spend 1-10 hours.

Majority of small business owners spend more than $1,000 on the administration of federal taxes:

- 15% of small business owners spend more than $10,000 on the administration of federal taxes.

- 16% spend $5,001–$10,000.

- 33% spend $1,001–$5,000.

- 15% spend $501–$1,000.

- 21% spend less than $500.

Recommended AI News: Automation Provides A Content Lifeline For Remote Work

“With tax compliance costing 67% higher for, this data supports the fact that owners are spending a considerable amount of time and money to ensure compliance,” said SCORE CEO Bridget Weston. “Luckily, there are a growing number of free tax assistance resources, including those available on SCORE.org, and the expert guidance of our mentors who are helping small business owners navigate their most timely and cost-effective tax compliance options.”

Recommended AI News: How the Death of Third-Party Cookies Will Benefit Your Digital Data Strategy

Comments are closed, but trackbacks and pingbacks are open.