New Global Mood Media Study Reveals Two-Thirds (67%) of Consumers Have Returned to Non-Essential Shopping In-Store

More than half predict shopping habits to return to normal by or before the summer of 2021

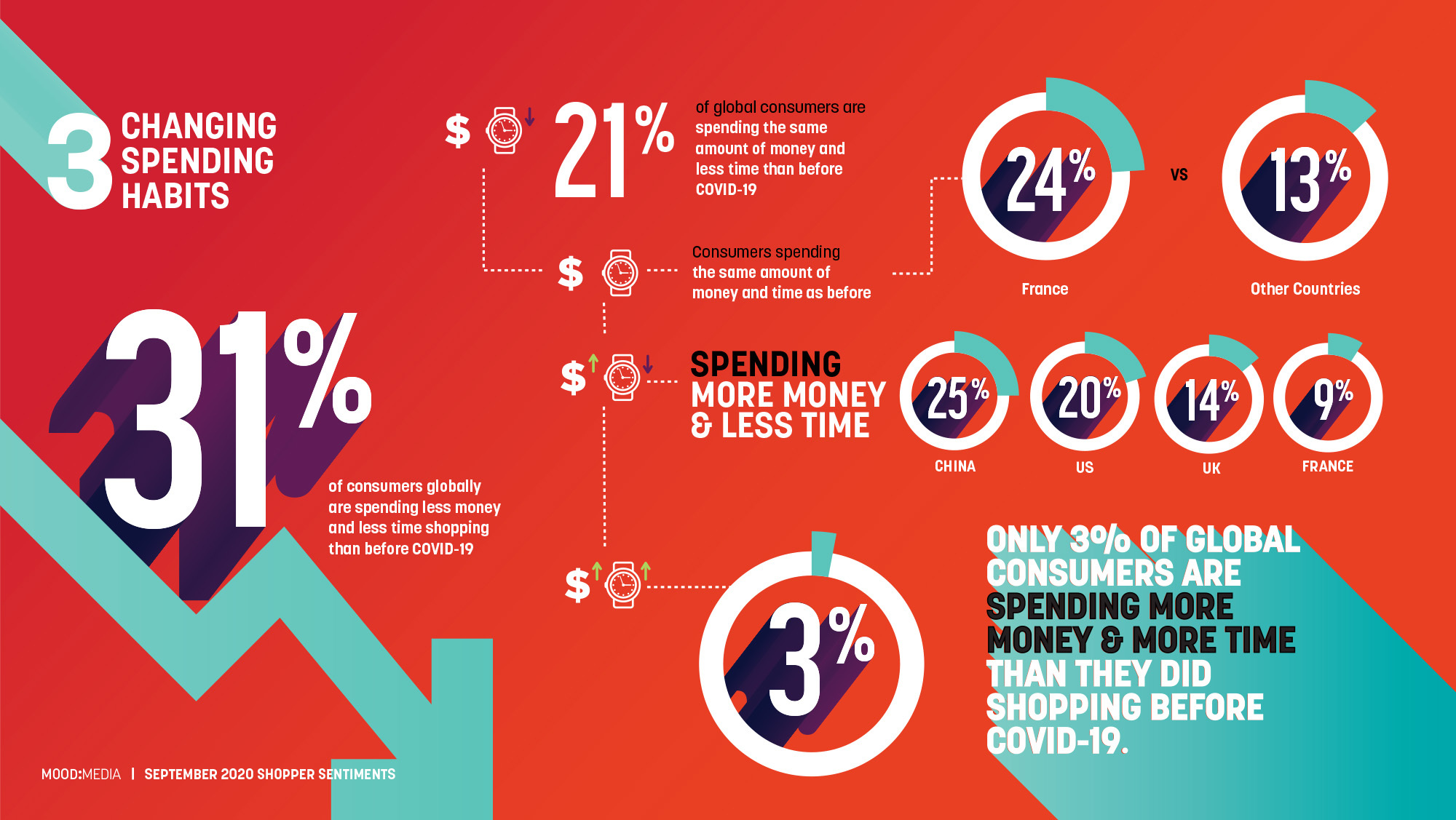

AUSTIN, Texas With COVID-19 lockdown measures around the world easing, just under three-quarters of global consumers (71%) now report feeling comfortable returning to physical stores since local lockdowns have eased, according to research published by Mood Media, the world’s leading on-premise media solutions company dedicated to elevating the Customer Experience. The new report, entitled “Shopper Sentiments: A September 2020 Global Mood Survey,” surveyed consumers across four major markets – the UK, U.S., China and France – finding that the largest portion of consumers surveyed (31%) are spending less money and less time shopping in-store than they did before COVID-19, compared with 21% spending the same amount of money but less time than before and only three percent spending both more money and more time than before the pandemic.

Initially commenting on the findings, Scott Moore,, Global Chief Marketing Officer (CMO) at Mood Media, said: “Consumers’ retail habits are still evolving as businesses slowly begin to open again. Many consumers are spending less time in store and less money per visit, meaning they’ve become mission shoppers focused on getting in and out as quickly as possible.”

Recommended AI News: Slone Partners Places Julianne Averill as Chief Financial Officer at Alveo Technologies

Conducted in partnership with Censuswide, over 8,000 consumers across the UK, US, China and France were surveyed to gain key insights into how consumers are adjusting their in-store shopping behaviors and developing new shopping patterns in today’s world. The research also finds that despite almost half (49%) of global consumers believing they might catch COVID-19 in-store, 80% feel comfortable with the new safety measures set in place, with the requirement of “all visitors wearing masks” cited as the most important measure that helps drive a sense of safety. Of the countries surveyed, the US population stands out as the most worried about catching COVID-19 in-store (60%), with the French expressing the lowest degree of concern about this possibility (39%).

Additional key US findings showcasing the impact of COVID-19 on in-store shopping behavior include:

- Reassurance from Safety Measures in-store: More than three-quarters of US consumers (76%) report feeling at least somewhat comfortable with the new health and safety measures placed in stores, and 37% report that these health and safety measures make them feel safer.

- Non-Essential Shopping:Sixty percent of US shoppers say they have already returned to non-essential retail stores, but only at a rate of 51% for those 55+ in age. US shoppers aged 16-24 are returning to non-essential shopping more conservatively than other countries surveyed, at a rate of 54% compared to a combined rate of 74% elsewhere.

- Changing Shopping Habits Among US Consumers:Of those comfortable returning to physical stores, 28% of US respondents reported spending less money and less time shopping than before the pandemic, while 20% in the US are spending more money and less time in-store than pre-pandemic. This highlights an overarching trend of consumers trying to spend less time in-store – regardless of their spend.

- Optimism Regarding a “Return to Normal”:Only 22% of US shoppers expect their shopping habits to “return to normal” by the end of 2020 (29% of males and 16% of females) while 24% don’t expect to fully resume their in-store shopping habits until the summer of 2021. Additionally, 16% predict it taking until the end of 2021 before shopping norms can resume. The most optimistic group in the US are males in the Southeast, where 34% believe normalcy will return by the end of 2020. The least optimistic US group are females in the West, where 24% don’t believe their consumer shopping habits will ever return to pre-pandemic norms.

Recommended AI News: Akoustis Appoints Former Grant Thornton, CEO, J. Michael McGuire, to Its Board of Directors

“Acknowledging and fulfilling today’s unique Customer Experience needs is where opportunity lies. Those of us in the physical retail business must continue to think through every aspect – every step – of the Customer Experience journey, finding ways to mitigate fear and assure safety along the way,” continued Moore. “Those businesses that step up to elevate the Customer Experience and help their customers streamline their shopping journey from start to finish have an opportunity to create a lifetime of customer loyalty far beyond the pandemic’s reach. For all parties involved, it’s important we all rise to the occasion.”

From a broader perspective, despite the high percentage (67%) of global consumers reporting that they have already returned to non-essential retail stores, the disparity of return rates, spending habits and optimism surrounding a return to normalcy across markets and other demographics is dramatic. Additional themes and associated highlights along these lines include the following:

Non-Essential Shopping Rates Vary Across Demographics

- It is evident from the research data that those nations where lockdowns eased earlier, such as China and France, are seeing greater rates of return to non-essential shopping (81% and 77% respectively). Where some lockdowns are still in place, consumers are warier, with only half of British (50%) and 60% of American consumers having returned to non-essential stores.

- Of those global consumers who have not returned, female consumers express more apprehension than males (41% vs 34% respectively).

- The level of comfort in going back to stores also decreases slightly but steadily across age groups, with the youngest surveyed being the most comfortable (77% of those aged 16-24) and the oldest group being the least comfortable (64% of those aged 55+).

Key Factors for not Returning to Non-Essential Shopping

- Economic reasons resulting from the pandemic are named by 20% of consumers globally as a reason for not yet going back to non-essential shopping, with Millennials being hit the hardest (27%) followed by the younger generation of 16-24 year-olds (25%). France and the US (24% and 22% respectively) reported this “lack of means” reason the most out of the markets surveyed.

- Other key factors cited among global respondents for why they haven’t returned to non-essential shopping include being “too nervous to visit non-essential retail” (at 38%), “doing all of my shopping online” (at 38%), and “someone does my shopping for me” (at 13%).

Changing Habits in-Store

- Of those comfortable returning to physical stores, the majority of respondents globally (31%) are spending less money and less time shopping than before the pandemic, with 30% of UK respondents and 28% of US respondents reporting this combination as well.

- Globally, only three percent report spending more money and more time in-store than prior to COVID-19.

- However, 29% of those in France cite still spending the same amount of money and time shopping in-store as before, while 26% of those in China are spending more money and less time in-store currently.

Optimism Varies Regarding an Expected Return to Normalcy

- Consumers globally are equally split between those that believe their consumer shopping habits will go back to normal by the end of 2020 (25.5%) and those that believe it will take until the summer of 2021 (25.4%).

- Only 10% of the global population think their shopping habits will never go back to what they were pre-Pandemic.

Recommended AI News: DISH Media Partners With Verizon Media to Automate Addressable Advertising

The Desire for the In-Store Shopping Experience Remains Strong

- The in-store sensorial experience still plays a crucial role, with the ability to touch, feel and try the product cited as the top reason for consumers globally to choose to buy in physical stores instead of online (47%), followed by the convenience of taking the purchase home instantly (46.6%) and the ability to browse and discover new things (36%).1

- Only eight percent of consumers globally cite that the safety measures put in place in stores have negatively impacted their experience.

Some Report Feeling More Comfortable in Certain Types of Physical Stores

- Sixty percent of respondents deny having specific kinds of stores where they feel more comfortable over others.

- Of the 40% globally who expressed feeling more comfortable visiting some types of stores, 45% cite trusting supermarkets & grocery stores more – which is also the most popular selection of both male and female respondents within each country surveyed. This is followed by local convenience stores and department stores (both at 29%), and technology & electronics stores (at 27% of global respondents).

- Technology & electronics stores came in as the second most trusted type of physical store for consumers between 16-54 years of age (at 29% on average), except for those aged 25-34 who have a slight preference for department stores (at 30%). Behind supermarkets (at 57%), those 55+ are most comfortable visiting local convenience stores (at a rate of 33%).

“The findings from this survey reinforce that initiatives such as overhead messaging and digital signage that inform shoppers of the steps being taken to ensure a clean environment are of paramount importance to increase comfort levels in-store. These types of efforts can help drive measurable value creation. Additionally, it’s clear that, for now, many consumers want a more efficient in-and-out experience, so retailers must find ways to help guide shoppers to what they need faster – and get them through the payment process with greater ease,” concluded Moore, Global CMO of Mood.

Recommended AI News: Simplilearn Collaborates With Gulf Business Machines for Employee Development in the Gulf Region

Comments are closed.