More than 70% of Customers would Switch Financial Institutions for Rich Video Content, According to SundaySky, PYMNTS Research

- Video-powered experience leader predicts increasing demand for financial digital experiences post-pandemic

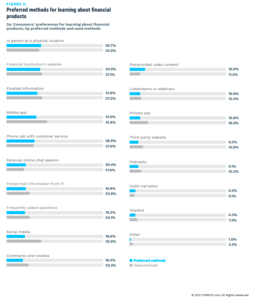

More than 70% of consumers would switch to another financial institution if it provided rich media video content and information through innovative media tools, according to new research from PYMNTS and SundaySky, the leading platform for video-powered experiences. Over the course of the pandemic, people were forced to adopt digital alternatives from their financial institutions, which wasn’t always easy. More than half of consumers find information on their financial institutions’ websites to be irrelevant to their needs, according to the Retail Banking Services’ Paradigm Shift report.

Poor access to information on websites is what drives 36% of consumers to physical branches, which encountered additional difficulty during the pandemic, due to the limited ability to visit physical branches to get answers to complicated questions. This caused people to turn to mobile apps, online chat and other digital alternatives, as well as rich media content like video. Forty-nine percent of respondents said they are engaging with their financial institutions through online chats more often than they did before the pandemic began. Additionally, nearly half of the respondents were interested in rich media to learn about financial products, citing better experiences and stronger engagement as drivers. As a result of the analysis of more than 2,200 respondents, SundaySky predicts financial institutions will need to rely on rich media content to engage with customers, as well as ensure it’s convenient and easy to use.

Poor access to information on websites is what drives 36% of consumers to physical branches, which encountered additional difficulty during the pandemic, due to the limited ability to visit physical branches to get answers to complicated questions. This caused people to turn to mobile apps, online chat and other digital alternatives, as well as rich media content like video. Forty-nine percent of respondents said they are engaging with their financial institutions through online chats more often than they did before the pandemic began. Additionally, nearly half of the respondents were interested in rich media to learn about financial products, citing better experiences and stronger engagement as drivers. As a result of the analysis of more than 2,200 respondents, SundaySky predicts financial institutions will need to rely on rich media content to engage with customers, as well as ensure it’s convenient and easy to use.

Recommended AI News: TCL Unveils Future Display Technologies and Next-Generation Mini-LEDs at CES 2021

“Although digital has accelerated in financial services this year, banking customers still vastly prefer to visit physical branches to learn about new products and services instead of absorbing lines of black and white text,” said PYMNTS Chief Executive Officer Karen Webster. “Financial brands that want to strengthen customer bonds will need to evolve digital experiences into deeper forms of immersion and personalization, which is where video can serve as a very effective form of media.”

Jim Dicso, Chief Executive Officer of SundaySky said, “People relied on face-to-face interactions to understand the details involved in getting a loan, investing in their retirement savings and other complicated financial decisions, but when a branch visit was no longer an option, a smooth digital experience is critical for customer loyalty. American Express, Bank of America, T. Rowe Price and other top financial institutions trust SundaySky to deliver the rich video experience that customers crave, which strengthens their loyalty and reduces unnecessary churn. Additionally, our Q4 customer survey revealed that 100% of our financial services customers receive high business value and impact from SundaySky.”

Recommended AI News: Neustar Announces Additions to Executive Leadership Team

Growing adoption of mobile apps, social media and personally relevant video signal their necessity, and financial institutions will need to offer these digital capabilities for enhanced brand stickiness even after the pandemic ends. Read the full Retail Banking Services’ Paradigm Shift report for more details.

Recommended AI News: Zyxel Communications Launches a Complete XGS-PON CPE Product Line Delivering 10G Broadband